What is the 15k Program? How Does it Work?

Virteom sits down with Joe Spooner to talk about what our company does to save you money and how it all works. Today we're talking about the 15k program and how it can save you money. Watch or read the transcription below!

What is the 15k program?

The 15k program is a great program that the bureau rolls out. It is another way for a company to potentially mitigate their risk on a claim. When we say that, we mentioned in another video, that there are safe driver claims (watch here) and those claims stick with you for four or five years down the road. That impact can be more significant than what the bureau actually pays for. The 15k program is for group rated employers who are safe drivers.

If employers have employees with a clean driving record, they can choose to keep them within the 15K program and pay per dollar on the claim. If somebody has an ambulance ride, you can pay that $800-$1,000 right out of pocket instead of letting it impact your premiums. A 15k program covers up to $15,000.

What types of claims are under the 15k program?

The 15k program is only for medical claims. If compensation gets paid in the claims or if eight days or more are missed, the company can't keep that claim in 15k.

Employer Benefits to the 15k Program

The nice thing for employers is that if they have a claim they know is going to be bad and they are participating in the 15K program, they can immediately choose to take that claim out of the 15k program. It’s nice to have the opportunity to pick and choose in these situations.

When you have an ongoing claim, it doesn’t hurt to talk to your employee, have them bring in their medical bills and review to make sure they’re being taken care of while making sure company costs are mitigated.

How Does the 15k Program Work?

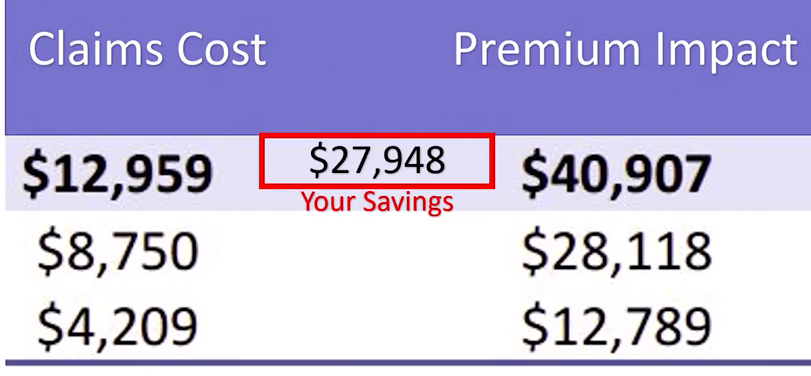

Let's look at an example of how the 15k program can help reduce costs:

In this chart (above) the bottom two numbers on the left, $8,750 and $4,209, are two different claims. Those numbers represent the actual cost and the bureau paid - (ex: $8,750). But if you were to not pay it out of the 15K program, the $28,118 (right column) is what that company would be charged in premium over the next four to five years. With the 15k program, paying on the dollar really is saving you a lot. The same goes for that $4,209 (pictured above), that claim ended up being impacted up to $12,789.

Now these claims represented (above) are a little bit different and you're probably wondering why that factor doesn't add up, but there are other actuarial factors that went into this. This is an actual example of one of our clients. The main purpose is to demonstrate that the per dollar cost is much more cost effective for a company rather than paying and letting the bureau impact you from a premium standpoint. By utilizing a 15k-type program, this company could have saved $27,948 by paying on the dollar and that would've been huge.

Get Started with Spooner Inc. Today

If you're looking for savings, deal with a lot of small claims, or would like to learn more about the 15k program, contact Spooner Inc. today.