News and Updates

Category: human resources

Cleveland Bans Inquiries on Applicant Salary History

Cleveland’s City Council approved a measure earlier this year prohibiting prospective employers from inquiring about an applicant’s salary history, and requires employers to include salary ranges in job postings. The new ordinance that became effective on October 27, 2025, applies to all Cleveland employers with 15 or more employees. The City of Cleveland is the latest of many municipalities (and even some states) across the U.S. that have passed similar laws in an effort to promote pay equity. Columbus passed a similar ordinance that took effect in 2024. Cleveland’s ordinance still permits discussing salary expectations with applicants, and doesn’t apply to applicants for internal transfer or promotion, salaries for positions set by collective bargaining agreements and governmental employers, other than the City of Cleveland itself. Considering the ordinance fails to define “salary range or scale,” complying with the new ordinance may leader employers to questions that don’t yet have answers. Employers found in violation of the ordinance may face civil fines up to $5000, depending on the number of violations within the last five years. If your business is based in the City of Cleveland and you have questions about how this may impact you, reach out to the SuretyHR team. If we aren’t able to directly answer your questions, we can engage our HR and legal partners to help you find the right

Year-End HR To-Do List

The final quarter of each year can be frustrating for HR departments and managers, as many companies choose to freeze their budgets this time of year. However, there are plenty of ways you can prepare for next year without much, if any, investment in 2025. Compliance: Make sure your organization has completed (and documented) required annual trainings, professional licenses are renewed, trade organization memberships renewed, etc. Review employee classifications, personnel files, etc. Compensation package review: Review pay structures for both hourly and salary, as well as benefits packages. You can use market comparisons, feedback from former employees’ exit interviews, and feedback from current employees to ensure you’re staying competitive. Remember: proactively paying employees what they’re worth is often easier (and less costly) than trying to match or beat a competitor’s offer to get them to stay put. Workforce Planning: Leadership should discuss potential for employee training for all levels of staff. Look back on the issues that have come up this year. What kind of knowledge and skills could help your staff avoid those pitfalls next year? Your local Chambers of Commerce, trade organizations, and consulting firms may have a lot more to offer than you realize! Employee Communication: Keep staff informed about important year-end info including benefit changes, holiday schedules, and tax documentation. It’s always a good idea to re

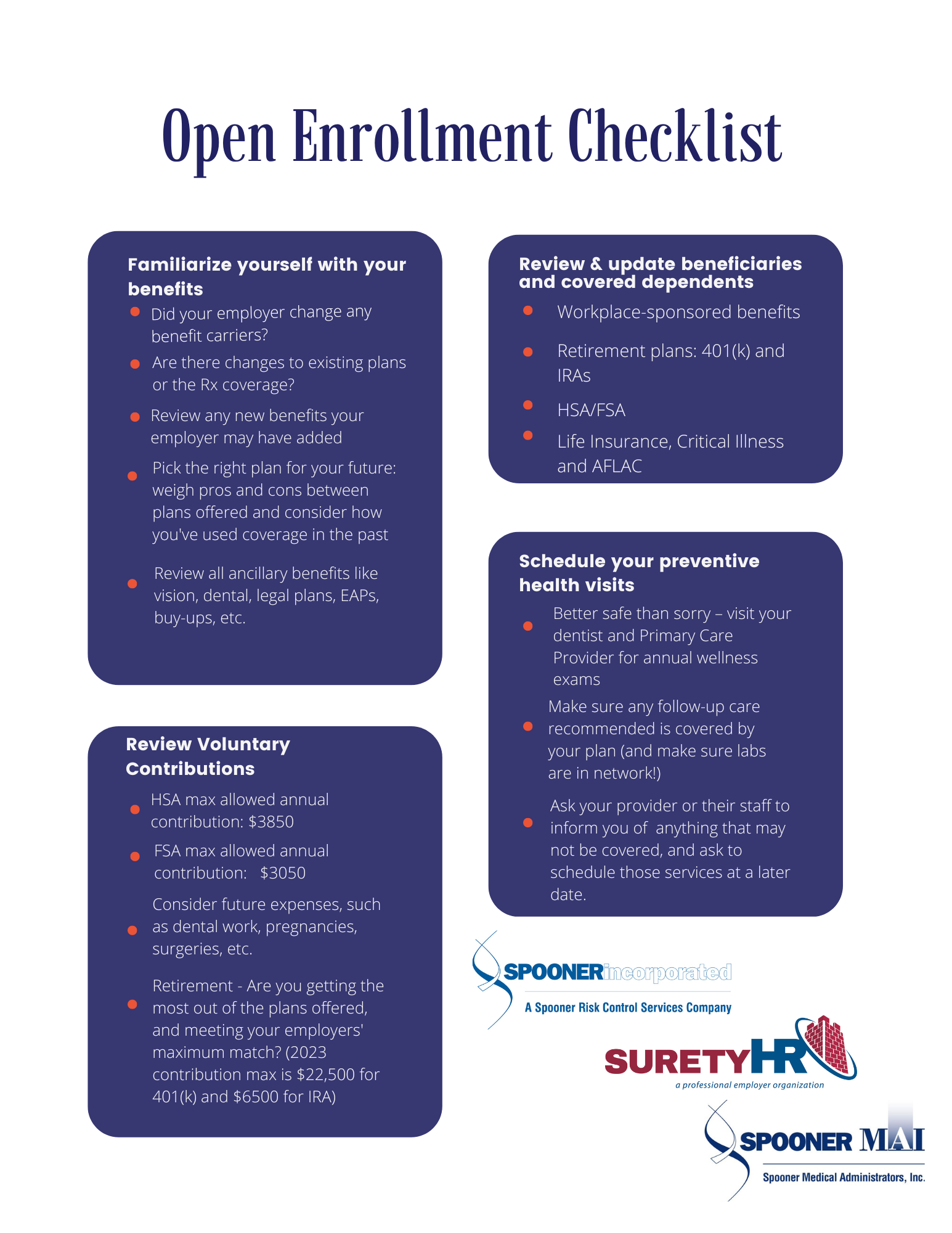

Open Enrollment Checklist for Employees

There's no shortage of checklists for HR managers and benefits administrators reminding them of what boxes to check during open enrollment. Those are great tools for management, but what about the group that tends to need the most guidance with benefits - employees? We put something together that you're free to download (just right click and save image), or you can request a high resolution printable by emailing

Outsourcing FMLA May Be the Break Your HR Department Needs Right Now

FMLA has been maligned by HR departments for years, not only because of the amount of work involved – but also the amount of expertise. Do you ever feel like your management team shouldn’t be the ones determining if a claim submitted actually qualifies? Throwing COVID-related leave into the mix didn’t help, either. Private companies that employ at least 50 workers (within a 75 mile radius), and public employers regardless of size are required to offer FMLA – 12 weeks unpaid leave during a 12 month period. While many question its value, considering the leave is unpaid – it was put in place to protect the jobs of those experiencing one of the following conditions: • Birth or adoption of a child • Care of a spouse, child or parent with a serious health condition • A serious health condition that renders the employee unable to complete their essential duties • A qualifying emergency related to a spouse, child or parent being on active military duty Non-compliance not only puts you on the radar of the Department of Labor (which could result in major fines), but could also expose you to private lawsuits from disgruntled employees. We hear a lot of businesses say, “We jus

Is There Room for Improvement With Your Payroll Provider?

If so, you should experience the Surety HR difference. Spooner's sister company Surety HR offers a customized payroll service that caters to the client’s wants and needs. The result is a payroll support team that knows your business and will excel at meeting your payroll needs. Our payroll service includes: Payroll processing with a full service payroll specialist & customer service rep Payroll tax specialists offering compliance support with Federal, State, Local and other authorities Detailed reporting options General Ledger support and consultation ACA support, reporting and consultation Employee self-service for paystubs and W-2s Please email Brian Davis if you have any questions. Brian can be reached at

How Solid Is Your HR Foundation?

Spooner's sister company, Surety HR has a staff of HR Professionals with the capabilities to provide a variety of solutions to any HR problem your company might be facing. While our PEO clients have these services embedded, they are available to all businesses. Some of the services we offer include: Handbook (policies and procedures) Compliance (I-9/EEOC/DOL/employee files) Disciplinary and termination guidance Harassment/bullying in workplace training Recruiting Job descriptions Employee performance evaluation Review hierarchy and comp structure Especially when it comes to issues of compliance, these are not things your company should leave to chance! A small investment now to get these things in place could potentially save you a fortune (and protect you from lawsuits) in the future. Please contact Todd Kereszturi for a free consultation. Todd can be reached at 440-249-5260 x132 or