News and Updates

Category: Group Rating

Find the Right Workers' Comp Partner for Your Business

Even though the 2025 BWC policy year is just about to kick off, we’re already preparing to quote 2026-27 policy year Group Rating and Group Retro programs. It can be hard to feel like a savvy buyer when it comes to workers’ comp in Ohio, but Spooner would like to share some pointers for how to understand the timeline and choose the best partner. If you’re thinking of changing your partner for Group Rating or Group Retro, DO NOT complete the renewal that your current TPA sends this summer. Employers often don't realize that cutting a check for a renewal in summer of 2025 obligates them to their current TPA through June of 2027. Make sure your accounting team is aware of this, too. We’ve seen too many unhappy customers of other TPAs get trapped this way. "Since our business is a member of XYZ Chamber of Commerce or trade association, we have to utilize their partner for workers’ comp programs." Not the case! The sponsoring organization frames it that way because there’s money on the table. For example, if your business belongs to XYZ Chamber (who happens to be partnered with a specific TPA) and you want to leave that TPA, the Chamber makes less money. Naturally, they want you to stay with their partner, and may even suggest that such a discount isn’t available outside of that partnership. This is patently false. Most TPAs have access to all of the same Group R

Group Rating Enrollment Ends November 15

The clock is ticking on Group Rating enrollment for the 2025 Ohio BWC policy year! The deadline for Group Rating paperwork is November 15, 2024. The Group Rating program provides upfront premium savings for qualified Ohio employers. If you are a Spooner client and are eligible for Group Rating, you should have already received your program renewal from us. If you haven’t, please reach out to your client services manager. If you’d like to receive a quote for Group Rating from Spooner Inc., we can accept requests through Wednesday, November 6. You can complete an authorization online by visiting this page. Keep in mind that waiting this long for a quote means you’d have a maximum of one week to make your decision once you receive it. No one likes feeling rushed, so we’d suggest getting your request in as soon as possible! Not all Ohio employers are eligible for Group Rating, and may want to consider the Group Retrospective program enrolls through January 27th. Usually referred to as Group Retro, employers enrolled in this program will see savings down the road once actual vs. expected losses are measured. For businesses that aren’t eligible for Group Rating, and don’t have the flexibility of waiting to see savings, we’d also encourage you to explore SuretyHR, our self-insured PEO (professional employer organization). SuretyHR is an alternative to being insured by Ohio BWC for workers’ compensation. By creating a

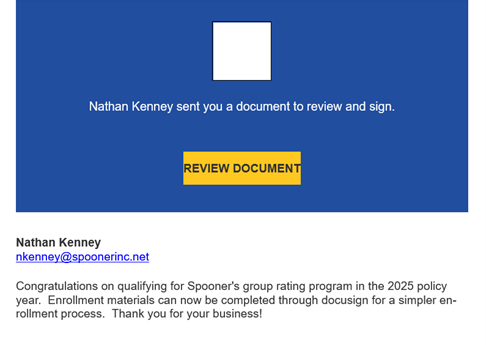

Group Rating Renewals Arriving via DocuSign

Earlier this summer (late June), Spooner sent Group Rating documents to many of our clients via DocuSign. If your policy had been enrolled in our Group Rating program for the current (2024-2025) policy year, your renewal documents would have been delivered this way. We understand that you may have been hesitant to open the email and/or click the link to complete the documents, or the email could have been intercepted as spam and you didn’t receive it at all. We’re working through contacting the Spooner clients who have not yet returned their Group Rating forms and can resend either via DocuSign or regular email. If you still have the email, you’re still able to complete the enrollment via DocuSign. It should appear similar to the picture below, showing Nathan Kenney as the sender. We apologize for any confusion this may have caused. Please reach out to your Client Services Manager with any additional questions on your 2025 program

Choosing the Best Workers' Comp Partner for '24-25

Even though the 2024 BWC policy year is just about to kick off, we’re already looking ahead to 2025 Group Rating and Group Retro programs. It can be hard to feel like a savvy buyer when it comes to workers’ comp in Ohio, but Spooner would like to share some pointers for how to understand the timeline and choose the best partner. If you’re thinking of changing your partner for Group Rating or Group Retro, be sure not to complete the renewal that your current TPA sends this summer. Most employers don’t realize that cutting a check for a renewal in summer of 2024 will obligate them to their current TPA through June of 2026. Make sure your accounting team is aware of this, too. We’ve seen too many unhappy customers of other TPAs get trapped this way. Are you under the impression that because you’re a member of XYZ Chamber of Commerce, you have to utilize their partner for workers’ comp programs? Not the case. The sponsoring organization frames it that way because there’s money on the table. For example, if you are an XYZ Chamber member (who happens to be partnered with a specific TPA) and you want to leave that TPA, XYZ Chamber makes less money. Naturally, they want you to stay with Sedgwick and may even advise you can’t get that discount outside of their partnership. This is patently false. Most TPAs have access to all of the same Group Rating and Group Retro programs for all industries, and the sponsoring org

2 Hour Safety Training Due June 30

If your company participated in Group Rating or Group Retro during the 2023 policy year (July 1, 2023-June 30, 2024) and had a claim during the green year(s), you’re required to complete two hours of safety training by June 30, 2024. Please be sure to complete submit the training certificates to your team at Spooner (or your TPA, if you’re not a Spooner client). If you’re unsure if you need to complete this training, reach out to your client services manager. The training doesn’t have to be completed in person – so there’s still time to meet the requirement by participating in one of BWC’s online courses. Here are some details on fulfilling the two-hour training requirement, per the Ohio BWC website. Two-hour Training Options A variety of training sources are available for you to fulfill this requirement. They include the following offered through BWC’s Division of Safety & Hygiene: • Education and Training Services Center courses • Ohio Safety Congress & Exposition (OSC) safety education sessions • Safety council seminars, workshops, or conferences featuring a safety topic that are at least two hours long (Safety council monthly meetings do not qualify.) Guidelines for courses offered through non-BWC training forums • The group sponsor, third-party administrator, or an independent sourc

2023-2024 Policy Year True Up with BWC

It’s almost True Up Time! BWC’s True Up window will begin on July 1, 2024 and will run through August 15, 2024. This is a process required by Ohio BWC at the end of each policy year, where your premiums based on projected payroll for the previous policy year are balanced with premiums based on your actual payroll over the past year. Compliance with both the reporting and payment of any balances affects your company’s eligibility for most savings programs (like Group and Group Retro). If your actual payroll was higher than projected, you’ll be expected to pay that balance to Ohio BWC no later than August 15th. If you are unable to pay the lump sum at that time, please note that any future premium installments will first be applied to your delinquent True Up Balance before being applied to your premium installments. Payment plans for True Up balances are only available through the Ohio Attorney General’s office following an application process. If this year’s True Up caught you by surprise, next year consider running a mock report in May or June to help your company prepare for any balance that may be owed. The payroll classifications and totals reported this summer will be used to determine your 2025 policy year premiums. For the 2024 policy year that will begin soon, BWC will be using payroll projections based on your True Up from July 2023. Adjustments to your estimated payroll can also be made throughout the year by contact

Choosing the Best Workers' Comp Partner for Your Business

Even though the 2023 BWC policy year just started, we’re already looking ahead to 2024 Group Rating and Group Retro programs. It can be hard to feel like a savvy buyer when it comes to workers’ comp in Ohio, but Spooner would like to share some pointers for how to understand the timeline and choose the best partner. If you’re thinking of changing your partner for Group Rating or Group Retro, be sure not to complete the renewal that your current TPA sends this summer. Most employers don’t realize that cutting a check for a renewal in summer of 2023 will obligate them to their current TPA through June of 2025. Make sure your accounting team is aware of this, too. We’ve seen too many unhappy customers of other TPAs get trapped this way. Are you under the impression that because you’re a member of XYZ Chamber of Commerce, you have to utilize their partner for workers’ comp programs? Not the case. The sponsoring organization frames it that way because there’s money on the table. For example, if you are an XYZ Chamber member (who happens to be partnered with a specific TPA) and you want to leave that TPA, XYZ Chamber makes less money. Naturally, they want you to stay with their TPA and may even advise you can’t get that discount outside of their partnership. This is patently false. Most TPAs have access to all of the same Group Rating and Group Retro programs for all industries, and the sponsoring orga

Mergers & Acquisitions and How They Impact Your Ohio BWC Policy

Thinking of Buying a Business in 2023? Congratulations! You’ve probably spoken to your banking partner, CPA and maybe a business advisor. What about your workers’ comp TPA? It’s typically the last thing on anyone’s mind while progressing through a merger or acquisition, but reviewing the workers’ comp policy should be part of the due diligence process. With a home purchase, you have a thorough inspection done by experts that know what to look for, and they provide a report on anything that could become costly down the road. If it that analysis makes it seem like a money pit, you may choose not to move forward. Shouldn’t a buyer also investigate every angle of a business purchase the same way? Even if the purchase is “in name only,” Ohio BWC has other ideas about how much of the previous owner’s problems you’ll inherit. Let’s say you already own one business, and you’re interested in purchasing another. Your existing business is enrolled in BWC’s Group Rating program, with a 40% discount on premiums. You cover all of the usual bases during the due diligence process – examine the seller’s overall financial health, debts, leases, contracts, and any other obligations. Everything appears to be in good shape. The transaction is complete, and you now own another business. You contact your workers’ comp TPA to let them know you have a new entity to cover for workers’ co

Under 30 Days to Enroll in Group Rating!

We understand that the businesses we serve are dealing with a lot right now - recruiting, attrition, staffing shortages, shipping delays and increasing costs on everything from benefits to raw materials. We can’t fix all of those problems for you, but we can make the process of saving money on BWC premiums a lot easier than it’s been in the past. Instead of completing hardcopies and mailing or emailing them to us, Spooner clients that completed Group Rating forms with us last year (and would like to remain in that program) can now complete their Group Rating renewal on our website. If we have any questions or concerns about your answers, we’ll reach out to the person that completed the form. Enrollment ends on 11/11! If you're not a Spooner client and would like us to provide your comany a quote on Group Rating, click the "Free Quote" link at the top of our page, and complete the form by

Group Rating Renewal is Now Even Easier for Spooner Clients!

We understand that the businesses we serve are dealing with a lot right now - recruiting, attrition, staffing shortages, shipping delays and increasing costs on everything from benefits to raw materials. We can’t fix all of those problem for you, but we can make the process of saving money on BWC premiums a lot easier than it’s been in the past. Instead of completing hardcopies and mailing or emailing them to us, Spooner clients that completed Group Rating forms with us last year (and would like to remain in that program) can now complete their Group Rating renewal on our website. If we have any questions or concerns about your answers, we’ll reach out to the person that completed