News and Updates

Category: True Up Reporting

2021 BWC True Up

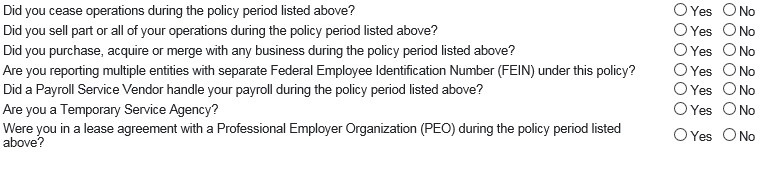

It’s that time of year again – Ohio BWC True Up! Employers can be intimidated by this process, but it should be relatively easy. Since state fund employers pay Ohio BWC premiums based on projected payrolls, everyone has to settle up at the end of the year. BWC policy years begin on July 1, and you have 7/1 through 8/15 to not only complete the reporting process, but also to pay any resulting balances. If you are unable to pay the entire balance at the end of the reporting process, any future premium payments will first be applied to your delinquent True Up Balance before being applied to any premium installments. Payment plans for True Up balances are only available through the Ohio Attorney General’s office following an application process (and having a balance with the AG could prevent you from getting into a savings program). Employers should also be prepared to answer the following questions as part of the True Up reporting process: This is a requirement for any Ohio employer with an open state fund policy, even if no payroll is allocated to the policy. Most self-insured PEOs ask that Ohio employers keep a state fund policy open and pay the annual minimum premium, but report no payroll to it. Even those employers are required to complete the report – essentially verifying that the estimate of $0 in payroll is still accurate. Your PEO might take care of this for you (SuretyHR does), or your payroll provider might assist you with the repor

2020 Policy Year True Up Reminder!

It’s a wrap on the 2020 policy year, which means you should be submitting your company’s annual payroll True Up to BWC. True Up is a process required by Ohio BWC at the end of each policy year, where your premiums based on projected payroll are balanced with premiums based on your actual payroll for the past year. Compliance with both the reporting and payment of any balances affects your company’s eligibility for most savings programs. The “deadline” to submit your payroll true-up reports on the Ohio BWC website is August 15th – but there are some finer details to consider. August 15 falls on a Sunday, which makes the deadline Friday August 13, realistically speaking. We’ve also learned that historically, you should allow 24 hours for posting – which makes the real deadline Thursday August 12. You will also need to pay any applicable balances if your payroll was higher than what the Ohio BWC estimated for the period of July 1, 2020 to June 30, 2021. Balances are expected to be paid during the designated reporting period, but there is a small grace period on both reporting and payments. If you are unable to pay the entire balance at the end of the reporting process, please note that any future payments will first be applied to your delinquent True Up Balance before being applied to your premium installments. Payment plans for True Up balances are only available through the Ohio Attorney