News and Updates

Category: payroll

Cleveland Bans Inquiries on Applicant Salary History

Cleveland’s City Council approved a measure earlier this year prohibiting prospective employers from inquiring about an applicant’s salary history, and requires employers to include salary ranges in job postings. The new ordinance that became effective on October 27, 2025, applies to all Cleveland employers with 15 or more employees. The City of Cleveland is the latest of many municipalities (and even some states) across the U.S. that have passed similar laws in an effort to promote pay equity. Columbus passed a similar ordinance that took effect in 2024. Cleveland’s ordinance still permits discussing salary expectations with applicants, and doesn’t apply to applicants for internal transfer or promotion, salaries for positions set by collective bargaining agreements and governmental employers, other than the City of Cleveland itself. Considering the ordinance fails to define “salary range or scale,” complying with the new ordinance may leader employers to questions that don’t yet have answers. Employers found in violation of the ordinance may face civil fines up to $5000, depending on the number of violations within the last five years. If your business is based in the City of Cleveland and you have questions about how this may impact you, reach out to the SuretyHR team. If we aren’t able to directly answer your questions, we can engage our HR and legal partners to help you find the right

Preparing for BWC True Up

The end of the Ohio BWC policy year will be ending on June 30th, which means it’s time to start thinking about your payroll True Up. Whether you’re an employer who reported late, not at all, or were unable to pay a resulting balance – you’re one of thousands who may have been removed from Group Rating, Group Retro or several other programs as a result. BWC takes timely reporting and balance payment very seriously, so it’s important that Ohio employers do as well! Most employers are familiar with the process and requirements by now, but here’s a recap for new policyholders and the uninitiated: BWC’s policy year runs July 1 through June 30. Ohio BWC uses payroll from two years prior to determine your premiums. If you’re a new policyholder, the payroll projection made on your application is used to calculate premiums. When the policy year ends, policyholders have from July 1 until August 15 to report their actual payroll from the past policy year Actual payroll is compared to projections that your premiums were based on, and there are three potential outcomes: break even, the employer owes BWC or BWC owes the employer. Any balance owed by the employer must be paid at the time of reporting to be considered current and in good standing. There are currently no options for payment plans outside of the balance being turned over to the Ohio Attorney General’s office. BWC’s billing hierarchy d

Grading Payroll Providers on Enrollment and W-2 Performance

With 2023 group health enrollments behind us, and W-2 season wrapping up – most employers have a strong opinion about the role their payroll provider played in both of those, good or bad. Let’s consider open enrollment first. If your payroll provider utilizes an electronic benefits module, and made an implementation plan with your broker – things should have gone smoothly. Benefits enrollment is always subject to hitting snags throughout the process. Here are some things to consider: • Was there communication between all parties if a timeline changed? • Was everyone pulling in the same direction, without making you (the employer) an unnecessary go-between? • Was every party involved invested in making sure things were done right the first time? • Have you considered an API connection or Data Bridge with your Carrier? (Fees may apply) It’s important not to over- or under-rely on technology. Let the electronic benefits modules do their job, but make sure you and your payroll provider have your eyes peeled for potential issues. W-2 season brings similar headaches. If the employer has done their best to ensure that all employee info is up-to-date and accurate, the prevention and resolution of those headaches’ rests heavily on your payroll provider. If employees have questions about W-2s, or there’s a potentia

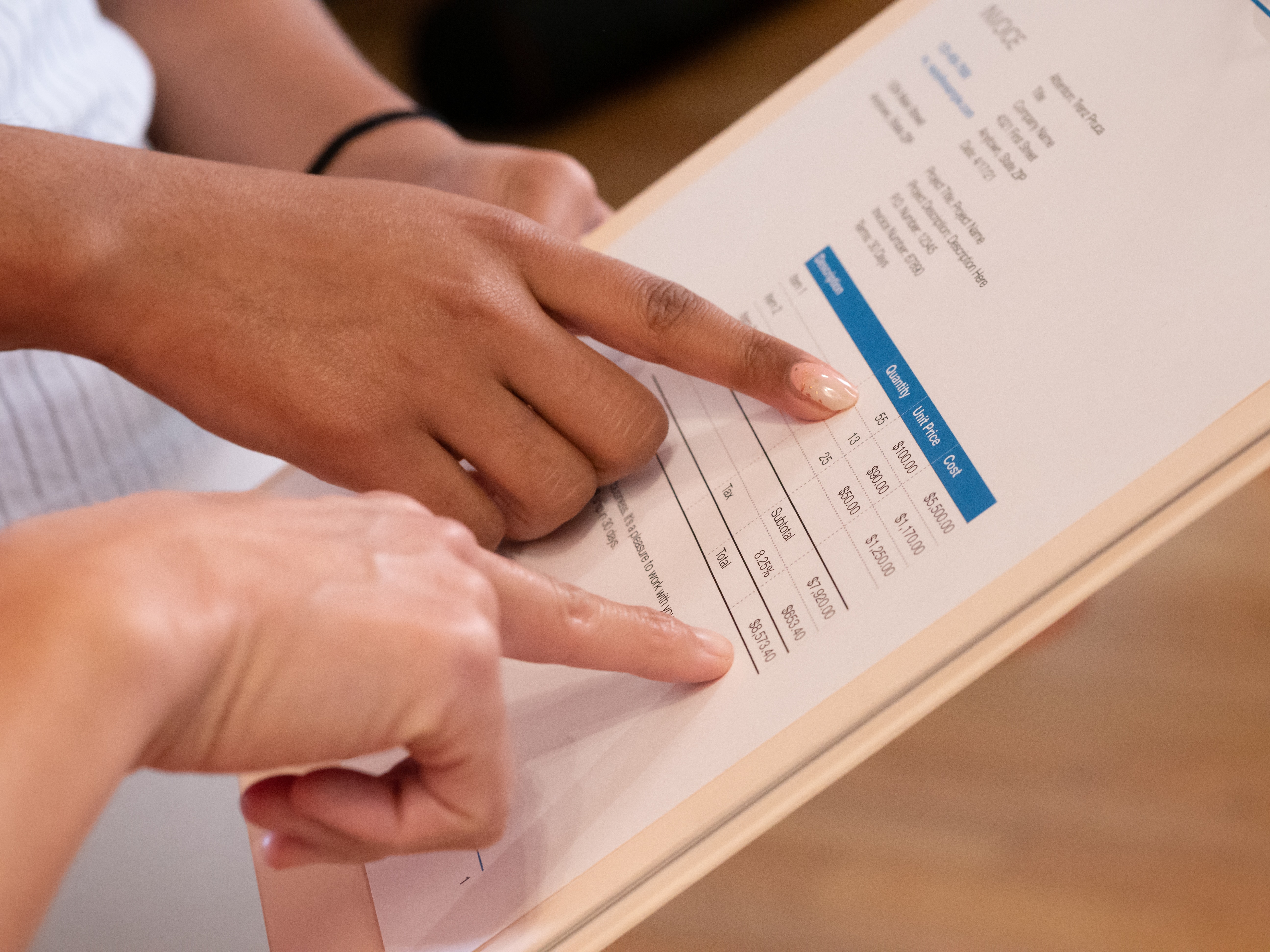

How Long Has It Been Since You Examined Your Payroll Invoice?

Probably too long. Maybe never? Donpayroll, overcharging, additional fees, s’t worry, you’re not alone. The person handling payroll at your company – be it the owner, HR, office manager or even dedicated payroll personnel – probably breathes a sigh of relief every week when the hard part is over and tries not to think about it for six more days. Given the stories clients have shared about “service” with other payroll processors, we can see why it’s no one’s favorite task. The only problem is, most people are so happy that it’s done that they don’t comb through their invoices from the payroll provider. When you look at it – are you seeing several other charges in addition to the per employee/per pay fee you were sold on when you signed? We’ve seen charges like $250 for submitting after 12pm on the designated day, or $30 per employee for W-2 processing at year-end. We’re here to tell you – that’s not “normal.” You may have been told it was perfectly normal during the sales process, that all payroll providers have these ancillary fees. Many payroll providers don’t, and SuretyHR certainly doesn’t. We’d be happy to review your most recent payroll invoice to make sure you’re getting the value promised for what you’re paying. If it turns out you’re being overcharged, we’ll do our best to help you find the right partner for your bus

Still Using NOVAtime?

If your company is using NOVAtime in conjunction with your payroll software for Time Tracking, it’s time to find a new solution. We’re not telling you this just because we have something better (we do, of course) – we’re telling you because it’s going to be outmoded soon. NOVAtime has been owned by Ascentis since 2018, and that parent company was purchased by another software company called UKG in March 2022. NOVAtime will officially be discontinued on January 1, 2023. SuretyHR may have the answer your organization is looking for. We have a time tracking solution that integrates seamlessly with PrismHR, Foundation (a popular construction management software), and plenty of other platforms. We use it internally, for our payroll- only clients, and our self-insured PEO clients (if you’re unsure what a self-insured PEO is, click here). There are tremendous advantages to partnering with a PEO, but the biggest roadblock tends to be the migration to a new payroll or time-keeping system. Businesses that have moved from one large payroll software to another don’t always have a seamless experience, and it has colored their thoughts on making a similar change in the future. SuretyHR clients that have migrated from many of the larger software providers have been more than happy not only with the tra

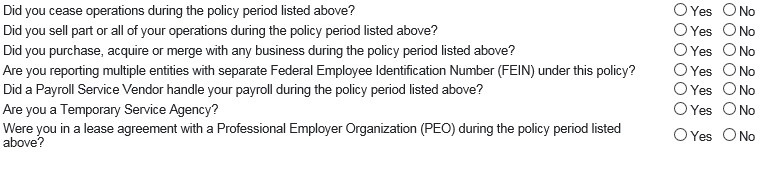

2021 BWC True Up

It’s that time of year again – Ohio BWC True Up! Employers can be intimidated by this process, but it should be relatively easy. Since state fund employers pay Ohio BWC premiums based on projected payrolls, everyone has to settle up at the end of the year. BWC policy years begin on July 1, and you have 7/1 through 8/15 to not only complete the reporting process, but also to pay any resulting balances. If you are unable to pay the entire balance at the end of the reporting process, any future premium payments will first be applied to your delinquent True Up Balance before being applied to any premium installments. Payment plans for True Up balances are only available through the Ohio Attorney General’s office following an application process (and having a balance with the AG could prevent you from getting into a savings program). Employers should also be prepared to answer the following questions as part of the True Up reporting process: This is a requirement for any Ohio employer with an open state fund policy, even if no payroll is allocated to the policy. Most self-insured PEOs ask that Ohio employers keep a state fund policy open and pay the annual minimum premium, but report no payroll to it. Even those employers are required to complete the report – essentially verifying that the estimate of $0 in payroll is still accurate. Your PEO might take care of this for you (SuretyHR does), or your payroll provider might assist you with the repor

Should We Cover Independent Contractors for Workers' Comp?

Don’t let the 1099 fool you. Just because your company doesn’t send these workers a W-2 doesn’t mean you shouldn’t cover them for workers’ compensation in Ohio. You may be thinking, “We’re not concerned – all of our 1099ers have a certificate of coverage from BWC.” Ok, so they knew that they had to manually elect coverage for themselves if they’re an LLC filing as a sole corp right? It can be more complicated than it appears on the surface, but we’re here to help you get a handle on it. Keep in mind this is not legal advice. If you have specific situations about classifying workers, you can always reach out to us, but sometimes it’s best to follow up with an employment attorney. Navigating the world of gig workers can be tricky, but just ask Ugicom – it’s best to classify workers correctly from the beginning. A lot of employers will casually mention that they don’t have to cover certain workers as employees for workers’ comp, because these people are independent contractors. Unless they come and go as they please with no schedule parameters, don’t utilize company vehicles or other property, and you have no say in the work they perform - they may in fact be independent contractors. If you can’t confidently tick all of those boxes, it may be time to reevaluate. When Ohio BWC performs a payroll audit, the

How SuretyHR Fits Into the Spooner Family

You may have noticed some of the SuretyHR content looks a lot like the content published on Spooner Inc’s website and LinkedIn. Maybe you also picked up on our employees having multiple logos on their emails, or you might have both Surety and Spooner business cards for the same employee. We get plenty of questions about this, so we want to help you make sense of it all. Surety HR is part of the Spooner Risk Control family of companies. Spooner Inc (our TPA) and Spooner Medical Administrators (our MCO) both have long and storied histories of helping employers navigate the claimant-favoring, monopolistic Ohio workers’ compensation system. We’ve saved thousands of companies hundreds of thousands of dollars, with some even into the millions with our claims and program management. As Ohio BWC continued making changes to programs, eligibility and inflating administrative costs, we found that offering solutions for only our state-fund and self-insured clients wasn’t enough. Enter SuretyHR, our professional employer organization (PEO). We began building the departments that would make up Surety HR in 2015, with the addition of payroll services. By 2017, we had added in-house legal counsel, HR experts and additional support to our existing teams handling workers’ comp, safety, unemployment, and absence management. In September 2019, we were granted self-insured status by Ohio BWC, which greatly increased the amount of savings we could

Surety HR: Not Your Average PEO

When we talk to prospects about Surety HR, our self-insured PEO (professional employer organization), we get a lot of very different reactions - confusion, curiosity, blank stares and occasionally – a crossed-arm refusal to hear anything else about it. We knew when we began building our PEO that several employers have a bad taste in their mouth about PEOs, usually after having (or hearing about) a bad experience. That’s one of the many reasons we sought out these opinions to help build our framework based on what employers feel does or does not work. The biggest thing we want to make clear is that we are not our competition. We don’t charge based on a percentage of payroll, baking everything together so that you’ll never really know how much you’re paying for any of our services. When employers are looking for some of the solutions a PEO can provide, they are not always looking to move all their employment-related needs under one umbrella. This is why larger, mature, and sophisticated companies have avoided entering into a PEO relationship. Surety HR is a sister company of Spooner Incorporated – an unrivaled TPA and consulting firm with less than 2% client turnover. Because of this foundation, our focus is more on lowering workers’ comp premiums instead of bundling services that you may not need or want. It also means if and when you decide it’s time to exit the PEO, the process will b

Preparing for True Up Following an Unprecedented Year

Starting July 1st, 2020, the BWC reduced every employer’s payroll by 20%. They did so under the assumption that all employers experienced slow-downs, lay-offs and closures during the initial impact of COVID-19 on Ohio businesses. However, they did not confirm these reductions with policyholders – and we know that not all businesses experienced a decrease. This reduction might result in an unexpected True Up balance July. True Up is a process required by Ohio BWC at the end of each policy year, where your premiums based on projected payroll are balanced with premiums based on your actual payroll for the past year. Compliance with both the reporting and payment of any balances affects your company’s eligibility for most savings programs. If your actual payroll was higher than projected, you will be expected to pay that balance to Ohio BWC no later than August 15th. If you are unable to pay the lump sum at that time, please note that any future premium installments will first be applied to your delinquent True Up Balance before being applied to your premium installments. Payment plans for True Up balances are only available through the Ohio Attorney General’s office following an application process. With the final installments for the 2020-2021 policy year being billed any day now, it is unlikely that you have time to make adjustments prior to the end of the policy year on 6/30/21. However, you can run a mock True Up based on