News and Updates

Category: HR

Recruiting Services Now Available to Spooner Clients

Earlier this year, we added a seasoned recruiter to our growing team of experts! Samantha Lafollette comes to us with over ten years of experience in the staffing and recruiting industries and also serves as the Northeast Ohio Area Director of the Ohio Staffing & Search Association. SuretyHR’s recruiting services can be utilized by any of our clients trying to find the right candidates for open positions. We can help evaluate your needs, develop a job description and implement a recruiting plan, handle interview scheduling and assist your team in narrowing down the candidate pools. Our flexibility and competitive fee structure could be exactly what your organization needs to enhance your in-house resources and find the best person for the role. To learn more about our recruiting services, please contact Samantha LaFollette directly

Cleveland Bans Inquiries on Applicant Salary History

Cleveland’s City Council approved a measure earlier this year prohibiting prospective employers from inquiring about an applicant’s salary history, and requires employers to include salary ranges in job postings. The new ordinance that became effective on October 27, 2025, applies to all Cleveland employers with 15 or more employees. The City of Cleveland is the latest of many municipalities (and even some states) across the U.S. that have passed similar laws in an effort to promote pay equity. Columbus passed a similar ordinance that took effect in 2024. Cleveland’s ordinance still permits discussing salary expectations with applicants, and doesn’t apply to applicants for internal transfer or promotion, salaries for positions set by collective bargaining agreements and governmental employers, other than the City of Cleveland itself. Considering the ordinance fails to define “salary range or scale,” complying with the new ordinance may leader employers to questions that don’t yet have answers. Employers found in violation of the ordinance may face civil fines up to $5000, depending on the number of violations within the last five years. If your business is based in the City of Cleveland and you have questions about how this may impact you, reach out to the SuretyHR team. If we aren’t able to directly answer your questions, we can engage our HR and legal partners to help you find the right

Year-End HR To-Do List

The final quarter of each year can be frustrating for HR departments and managers, as many companies choose to freeze their budgets this time of year. However, there are plenty of ways you can prepare for next year without much, if any, investment in 2025. Compliance: Make sure your organization has completed (and documented) required annual trainings, professional licenses are renewed, trade organization memberships renewed, etc. Review employee classifications, personnel files, etc. Compensation package review: Review pay structures for both hourly and salary, as well as benefits packages. You can use market comparisons, feedback from former employees’ exit interviews, and feedback from current employees to ensure you’re staying competitive. Remember: proactively paying employees what they’re worth is often easier (and less costly) than trying to match or beat a competitor’s offer to get them to stay put. Workforce Planning: Leadership should discuss potential for employee training for all levels of staff. Look back on the issues that have come up this year. What kind of knowledge and skills could help your staff avoid those pitfalls next year? Your local Chambers of Commerce, trade organizations, and consulting firms may have a lot more to offer than you realize! Employee Communication: Keep staff informed about important year-end info including benefit changes, holiday schedules, and tax documentation. It’s always a good idea to re

Legal Considerations for Company Holiday Parties

Some company holiday parties are legendary, whether it was a cheerful good time for all involved, or a full-on fiasco. There was even a movie made about them, which we're convinced could be based on real stories from HR managers around the world. The merriment comes with legal considerations that should be weighed ahead of time, so your management team can avoid the dreaded "over-served" employee(s). Speaking of covering your bases, we're obligated to remind you that this is not legal advice. If you have concerns about the risk associated with throwing a holiday party for employees, please consult your business counsel. Attendance - Make sure all employees are included in the party, but attendance should be voluntary. The focus of the party should be on celebrating the employees and not about a particular holiday. Avoid referring to the party as a “Christmas Party,” and just call it a “Holiday Party,” or an “End of the Year

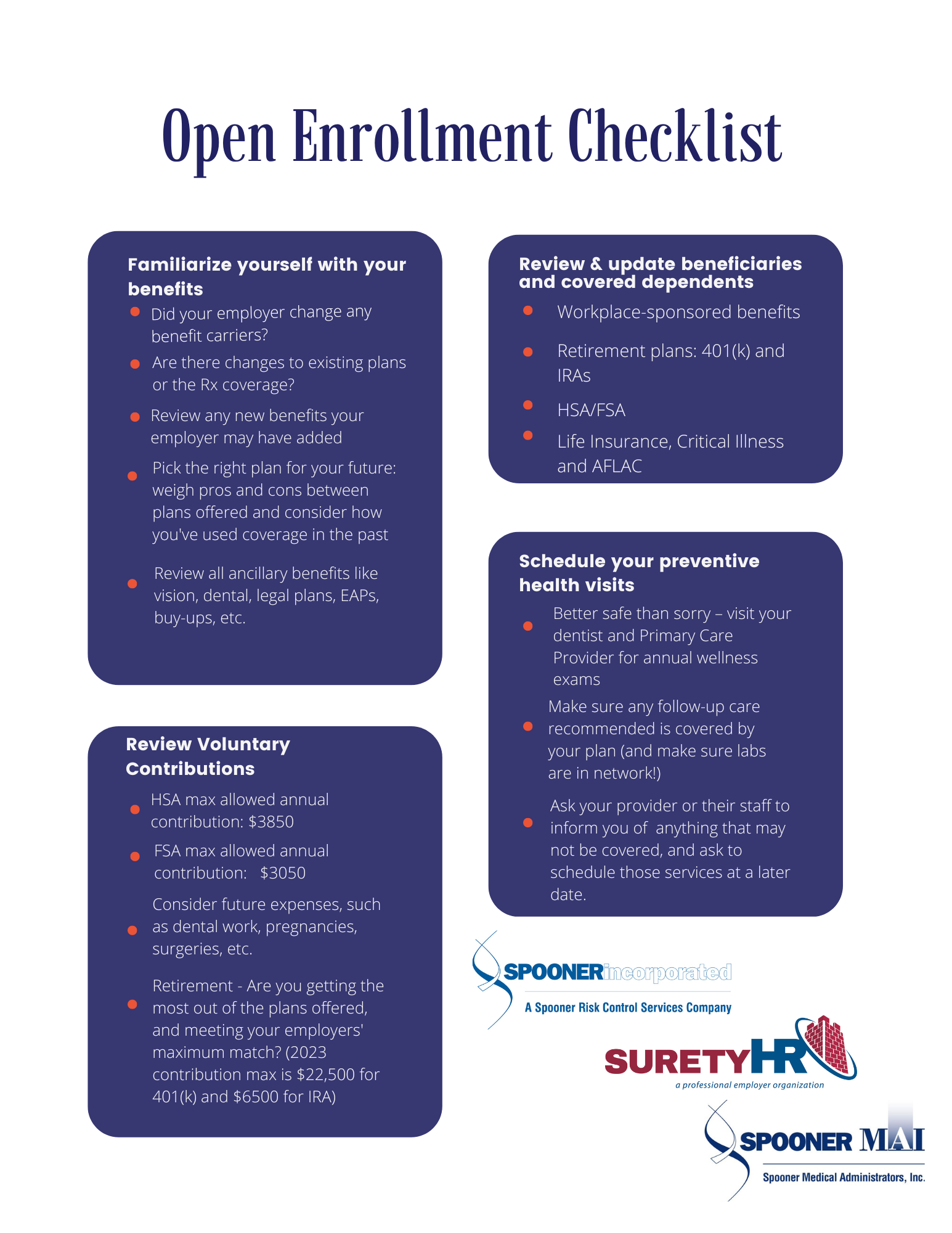

Open Enrollment Checklist for Employees

There's no shortage of checklists for HR managers and benefits administrators reminding them of what boxes to check during open enrollment. Those are great tools for management, but what about the group that tends to need the most guidance with benefits - employees? We put something together that you're free to download (just right click and save image), or you can request a high resolution printable by emailing

Spooky, but Safe!

Lily Spooner, taking a break from her coven duties to see who has treats. It’s close to midnight, and something evil’s lurking in the…break room? There’s no time of year quite like Halloween to turn up the fun at work. Carry-ins, costume contests, decorations, and candy can bring even the more introverted employees out of their shells. The same environment can also work Halloween-lovers into a lather with complicated costumes, pranks and jump scares. Believe it or not, Halloween hijinks in the workplace have resulted in quite a few workers’ comp claims. The staff at Spooner loves a good spooky time, so we’ll share some tips that will allow you to keep the festivities going – and keep them safe. Costumes There’s always at least one person who’s worked on their costume for weeks and can’t wait to debut it for the contest at work. If you’re planning on allowing employees to wear costumes to work, you may want to lay a few ground rules ahead of time. Loose/flowy (dresses, sleeves, capes, etc.) – Anything below ankle length is likely to get stepped on or caught on something, even in an office environment. Long, flowy sleeves or loose fabric is even more dangerous in an industrial setting, where it could get caught in machinery. Bulky costumes – Everyone gets a kick out of the T-rex costume until things start getting knocked over. Better to save these costumes for passing out candy

Outsourcing FMLA May Be the Break Your HR Department Needs Right Now

FMLA has been maligned by HR departments for years, not only because of the amount of work involved – but also the amount of expertise. Do you ever feel like your management team shouldn’t be the ones determining if a claim submitted actually qualifies? Throwing COVID-related leave into the mix didn’t help, either. Private companies that employ at least 50 workers (within a 75 mile radius), and public employers regardless of size are required to offer FMLA – 12 weeks unpaid leave during a 12 month period. While many question its value, considering the leave is unpaid – it was put in place to protect the jobs of those experiencing one of the following conditions: • Birth or adoption of a child • Care of a spouse, child or parent with a serious health condition • A serious health condition that renders the employee unable to complete their essential duties • A qualifying emergency related to a spouse, child or parent being on active military duty Non-compliance not only puts you on the radar of the Department of Labor (which could result in major fines), but could also expose you to private lawsuits from disgruntled employees. We hear a lot of businesses say, “We jus

Supreme Court Reissues Stay on Vax-or-Test Requirement, Mandate Remains in Place for Most Healthcare Workers

OSHA announced on January 26 that they plan to withdraw the ETS, but that the rule would still be proposed as a permanent requirement. This comes just weeks after the Supreme Court reinstituted a stay of the OSHA’s Emergency Temporary Standard (ETS) earlier this month, requiring large employers to require staff to be vaccinated or produce a weekly negative test. In their January 13th decision, the Supreme Court maintained that while COVID-19 exists as a risk in most workplaces, they do not view it as a strictly occupational hazard. The majority opinion states that targeted regulations may be permissible - citing workplaces that are particularly crowded or cramped, or laboratories that work directly with the virus for research purposes. In a separate opinion on January 13, the high court did allow CMS (Center for Medicare & Medicaid Services) to require COVID-19 vaccinations for employees of healthcare facilities receiving federal funds from Medicare & Medicaid. OSHA initially published the ETS on November 5. A flurry of legal action followed from both private and public employers, and by November 12 - the 5th Circuit Court of Appeals issued a stay of the ETS (making the ETS invalid). To further complicate matters, the 6th Circuit voted 2-1 to reinstate the mandate on December 17. Some employers are choosing to create their own vaccine mandates, which should be handled carefully to avoid discrimination. If you have questio

Have Questions About the Imminent Vaccine Mandate? So Do We.

Last month, President Biden directed OSHA to issue an Emergency Temporary Standard (ETS) that requires private employers with 100+ employees to ensure all employees are either vaccinated against the COVID-19 virus or are able to produce a negative test each week. Employers (of any size) that are federal contractors or receive certain federal funding will also be expected to meet the employee vaccination requirements – without the option of a “test out.” We expect OSHA to issue an ETS in the near future, which will hopefully answer some of the questions surrounding this mandate. Until this summer’s COVID-related ETS for healthcare workers, OSHA had not successfully issued an Emergency Temporary Standard since the 1980s (pertaining to asbestos). Effective July 2021, the agency issued its first ETS in decades highlighting the need for healthcare employers to provide certain protection measures against COVID-19 for employees. By design, an ETS will remain in effect until a permanent rule is issued. Many details of how this is all expected to work have yet to be disclosed, which makes it very difficult for our team to provide the best possible guidance. In the meantime, we can direct you to the most helpful reference we’ve found thus far, which is an article published by the National Law Review. We encourage you to stay tuned to our blog, LinkedIn page and your outside counsel – things are changing rapidly and we’ll do our very bes

Surety HR: Not Your Average PEO

When we talk to prospects about Surety HR, our self-insured PEO (professional employer organization), we get a lot of very different reactions - confusion, curiosity, blank stares and occasionally – a crossed-arm refusal to hear anything else about it. We knew when we began building our PEO that several employers have a bad taste in their mouth about PEOs, usually after having (or hearing about) a bad experience. That’s one of the many reasons we sought out these opinions to help build our framework based on what employers feel does or does not work. The biggest thing we want to make clear is that we are not our competition. We don’t charge based on a percentage of payroll, baking everything together so that you’ll never really know how much you’re paying for any of our services. When employers are looking for some of the solutions a PEO can provide, they are not always looking to move all their employment-related needs under one umbrella. This is why larger, mature, and sophisticated companies have avoided entering into a PEO relationship. Surety HR is a sister company of Spooner Incorporated – an unrivaled TPA and consulting firm with less than 2% client turnover. Because of this foundation, our focus is more on lowering workers’ comp premiums instead of bundling services that you may not need or want. It also means if and when you decide it’s time to exit the PEO, the process will b