News and Updates

Month: November 2022

Respiratory Protection, Fit Testing & Written Programs

If your workplace exceeds the permissible exposure limits of airborne contaminants (more on that here), there are a few items you should have in place, starting with a written respiratory protection program. If this isn’t something your own safety staff is comfortable putting together, you can outsource it to a third party. Spooner’s safety team is well-versed in helping develop these types of programs to help businesses remain compliant. Once the written program is finalized, you’ll need to select the appropriate respirator based on the type of exposure. After both of those tasks are complete, it’s time to schedule respirator fit testing. Even though a pulmonary function test (PFT) is not always required by OSHA prior to wearing a respirator on the job, the medical provider performing the certification may require a PFT as part of the process. A PFT is required for employees wearing respirators for protection from asbestos, cotton dust, benzene, formaldehyde, silica and beryllium, to name a few. Any employee planning on wearing a respirator at work will need to complete OSHA’s Respirator Questionnaire. Simply asking your employees to complete one prior to wearing a respirator isn’t sufficient - OSHA requires that a physician [or other licensed health care professional (PLHCP)] to review the questionnaire. How the form is completed is determined by the type of respirator worn, and certain responses may serve as a red flag that additio

How Long Has It Been Since You Examined Your Payroll Invoice?

Probably too long. Maybe never? Donpayroll, overcharging, additional fees, s’t worry, you’re not alone. The person handling payroll at your company – be it the owner, HR, office manager or even dedicated payroll personnel – probably breathes a sigh of relief every week when the hard part is over and tries not to think about it for six more days. Given the stories clients have shared about “service” with other payroll processors, we can see why it’s no one’s favorite task. The only problem is, most people are so happy that it’s done that they don’t comb through their invoices from the payroll provider. When you look at it – are you seeing several other charges in addition to the per employee/per pay fee you were sold on when you signed? We’ve seen charges like $250 for submitting after 12pm on the designated day, or $30 per employee for W-2 processing at year-end. We’re here to tell you – that’s not “normal.” You may have been told it was perfectly normal during the sales process, that all payroll providers have these ancillary fees. Many payroll providers don’t, and SuretyHR certainly doesn’t. We’d be happy to review your most recent payroll invoice to make sure you’re getting the value promised for what you’re paying. If it turns out you’re being overcharged, we’ll do our best to help you find the right partner for your bus

Is Our Company Allowed to Pay Cash for Workers' Comp Treatment in Ohio?

We know it happens. An employer pays cash at an urgent care for that “one and done” work-related injury visit, or maybe a handful of chiropractor visits. The employer didn’t want the claims costs hitting their experience and premiums, or to risk their EMR going even higher. Unless they’re in one of a few specific programs, employers paying cash for treatment of a work-related injury is prohibited. It can go left quickly and create some ugly scenarios for employers. We want to help you understand what can happen, and some above-board ways to reduce the impact of medical costs on future premiums. Paying cash for an injured worker’s medical treatment is a slippery slope. Ohio BWC-approved providers should not be willing to accept an employer’s cash payment for treatment unless they are self-insured for workers’ comp in Ohio, part of the 15K program, or an Ohio-BWC approved deductible plan. If an employee hurts their back at work and claims they just want to see a chiropractor - it may seem both easy and tempting to pay cash for a few visits. No need to file a claim and make a big deal of it, right? Wrong. Especially with soft tissue injuries, treatment could go on for months (even years), and may eventually require an orthopedic surgeon. When BWC finds out that the initial injury wasn’t reported as a claim and the employer chose to pay cash for treatment, that employer now has a non-covered claim. That means the employer will b

Mergers & Acquisitions and How They Impact Your Ohio BWC Policy

Thinking of Buying a Business in 2023? Congratulations! You’ve probably spoken to your banking partner, CPA and maybe a business advisor. What about your workers’ comp TPA? It’s typically the last thing on anyone’s mind while progressing through a merger or acquisition, but reviewing the workers’ comp policy should be part of the due diligence process. With a home purchase, you have a thorough inspection done by experts that know what to look for, and they provide a report on anything that could become costly down the road. If it that analysis makes it seem like a money pit, you may choose not to move forward. Shouldn’t a buyer also investigate every angle of a business purchase the same way? Even if the purchase is “in name only,” Ohio BWC has other ideas about how much of the previous owner’s problems you’ll inherit. Let’s say you already own one business, and you’re interested in purchasing another. Your existing business is enrolled in BWC’s Group Rating program, with a 40% discount on premiums. You cover all of the usual bases during the due diligence process – examine the seller’s overall financial health, debts, leases, contracts, and any other obligations. Everything appears to be in good shape. The transaction is complete, and you now own another business. You contact your workers’ comp TPA to let them know you have a new entity to cover for workers’ co

Legal Considerations for Company Holiday Parties

Some company holiday parties are legendary, whether it was a cheerful good time for all involved, or a full-on fiasco. There was even a movie made about them, which we're convinced could be based on real stories from HR managers around the world. The merriment comes with legal considerations that should be weighed ahead of time, so your management team can avoid the dreaded "over-served" employee(s). Speaking of covering your bases, we're obligated to remind you that this is not legal advice. If you have concerns about the risk associated with throwing a holiday party for employees, please consult your business counsel. Attendance - Make sure all employees are included in the party, but attendance should be voluntary. The focus of the party should be on celebrating the employees and not about a particular holiday. Avoid referring to the party as a “Christmas Party,” and just call it a “Holiday Party,” or an “End of the Year

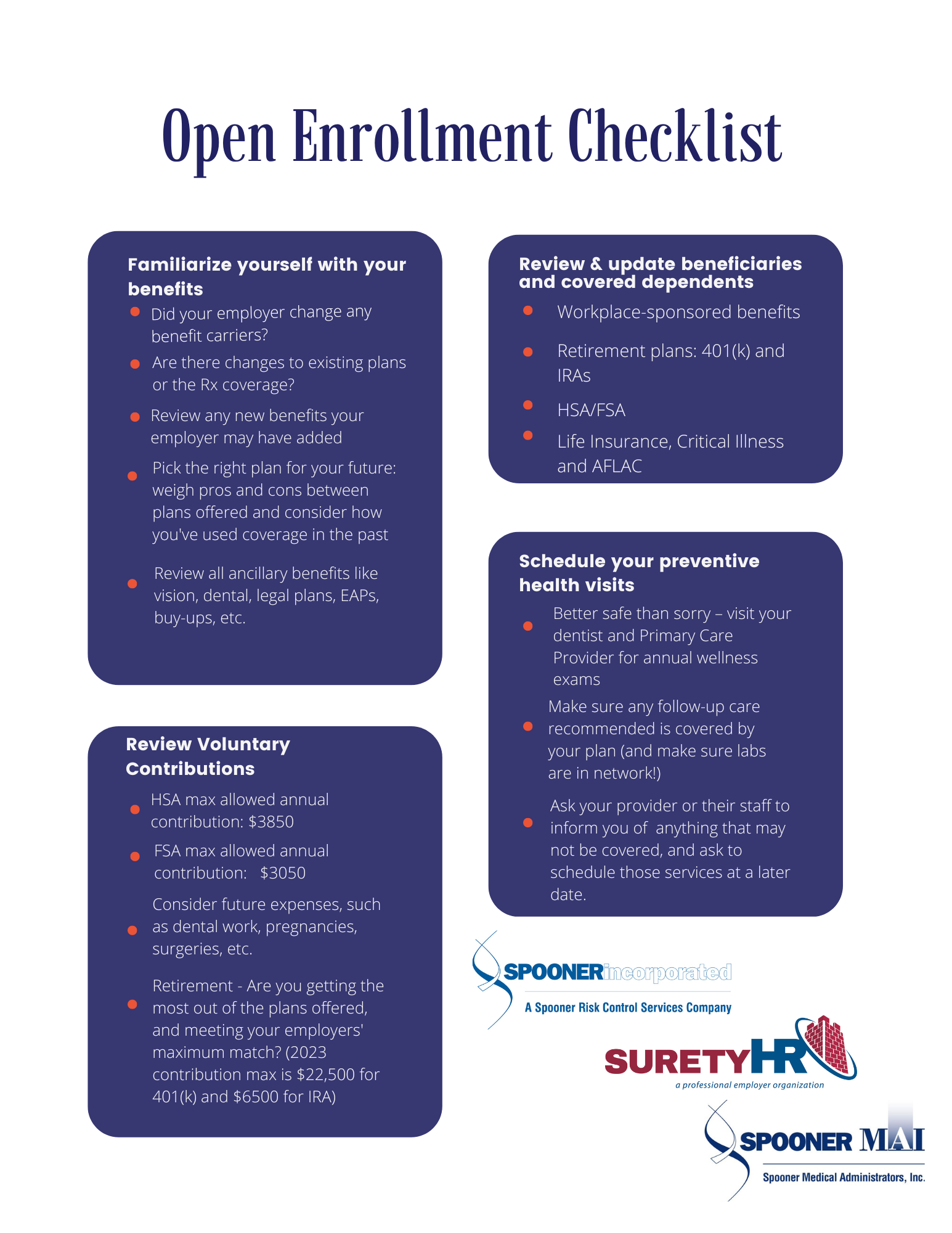

Open Enrollment Checklist for Employees

There's no shortage of checklists for HR managers and benefits administrators reminding them of what boxes to check during open enrollment. Those are great tools for management, but what about the group that tends to need the most guidance with benefits - employees? We put something together that you're free to download (just right click and save image), or you can request a high resolution printable by emailing

Disappointed with Your 2020 Group Retro Refund?

You’re not alone. Now that BWC is releasing the first Group Retro checks (and a few assessments) for the 2020 policy year, many Ohio employers are underwhelmed by the results. In the earlier days of Group Retro, it wasn’t unheard of to see refunds over 50%. Spooner certainly had its heyday in the program, with some of our industry groups reaching close to the maximum return of 63%. In the last ten years, we’ve seen several factors begin to chip away at these big returns: increased loss development factors, fewer premium dollars in pools due to Premium Size Factor Reductions, and more recently – the move to a new reserve calculating system called ACES. The first two changes caused average returns to dip into the 40% ranges, but huge reserves from ACES delivered a sucker punch that left only five of the best performing groups with returns over 40%. Five of the hardest-hit pools will receive an assessment, which means paying back anywhere between 15-25% of their 2020 premiums to BWC. All other groups in the middle of the best and worst averaged returns of less than 24%. For some, that’s less than half of their historical performance average. We’ve been tracking the impact of ACES on Group Retro for a while now, and several TPAs (including Spooner) have voiced their concerns to BWC regarding the dwindling returns. While the complaints were taken under advisement, BWC chose to make such minor changes to the reserve calculations t