News and Updates

Category: SI PEO

Grading Payroll Providers on Enrollment and W-2 Performance

With 2023 group health enrollments behind us, and W-2 season wrapping up – most employers have a strong opinion about the role their payroll provider played in both of those, good or bad. Let’s consider open enrollment first. If your payroll provider utilizes an electronic benefits module, and made an implementation plan with your broker – things should have gone smoothly. Benefits enrollment is always subject to hitting snags throughout the process. Here are some things to consider: • Was there communication between all parties if a timeline changed? • Was everyone pulling in the same direction, without making you (the employer) an unnecessary go-between? • Was every party involved invested in making sure things were done right the first time? • Have you considered an API connection or Data Bridge with your Carrier? (Fees may apply) It’s important not to over- or under-rely on technology. Let the electronic benefits modules do their job, but make sure you and your payroll provider have your eyes peeled for potential issues. W-2 season brings similar headaches. If the employer has done their best to ensure that all employee info is up-to-date and accurate, the prevention and resolution of those headaches’ rests heavily on your payroll provider. If employees have questions about W-2s, or there’s a potentia

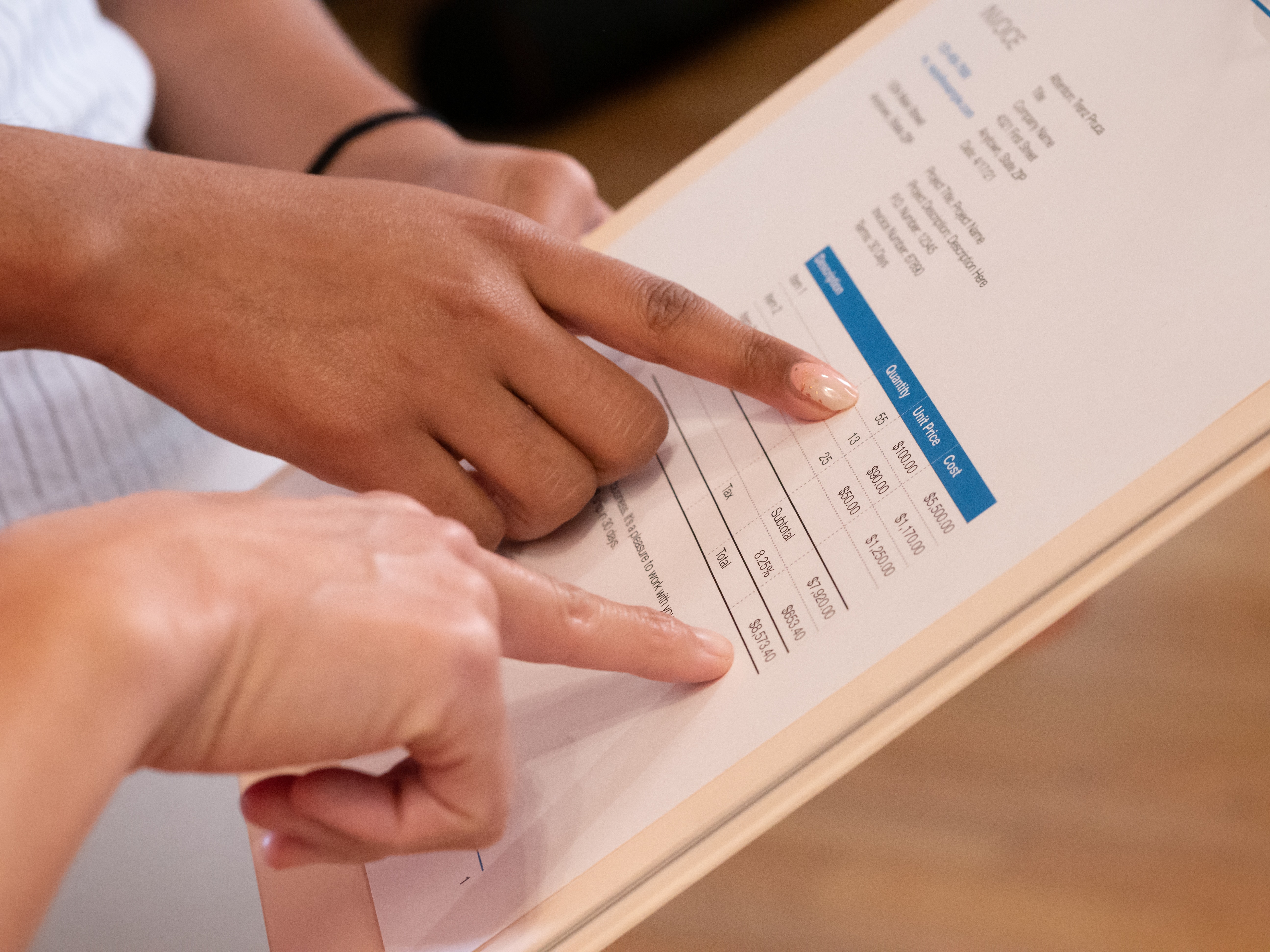

How Long Has It Been Since You Examined Your Payroll Invoice?

Probably too long. Maybe never? Donpayroll, overcharging, additional fees, s’t worry, you’re not alone. The person handling payroll at your company – be it the owner, HR, office manager or even dedicated payroll personnel – probably breathes a sigh of relief every week when the hard part is over and tries not to think about it for six more days. Given the stories clients have shared about “service” with other payroll processors, we can see why it’s no one’s favorite task. The only problem is, most people are so happy that it’s done that they don’t comb through their invoices from the payroll provider. When you look at it – are you seeing several other charges in addition to the per employee/per pay fee you were sold on when you signed? We’ve seen charges like $250 for submitting after 12pm on the designated day, or $30 per employee for W-2 processing at year-end. We’re here to tell you – that’s not “normal.” You may have been told it was perfectly normal during the sales process, that all payroll providers have these ancillary fees. Many payroll providers don’t, and SuretyHR certainly doesn’t. We’d be happy to review your most recent payroll invoice to make sure you’re getting the value promised for what you’re paying. If it turns out you’re being overcharged, we’ll do our best to help you find the right partner for your bus

Is Our Company Allowed to Pay Cash for Workers' Comp Treatment in Ohio?

We know it happens. An employer pays cash at an urgent care for that “one and done” work-related injury visit, or maybe a handful of chiropractor visits. The employer didn’t want the claims costs hitting their experience and premiums, or to risk their EMR going even higher. Unless they’re in one of a few specific programs, employers paying cash for treatment of a work-related injury is prohibited. It can go left quickly and create some ugly scenarios for employers. We want to help you understand what can happen, and some above-board ways to reduce the impact of medical costs on future premiums. Paying cash for an injured worker’s medical treatment is a slippery slope. Ohio BWC-approved providers should not be willing to accept an employer’s cash payment for treatment unless they are self-insured for workers’ comp in Ohio, part of the 15K program, or an Ohio-BWC approved deductible plan. If an employee hurts their back at work and claims they just want to see a chiropractor - it may seem both easy and tempting to pay cash for a few visits. No need to file a claim and make a big deal of it, right? Wrong. Especially with soft tissue injuries, treatment could go on for months (even years), and may eventually require an orthopedic surgeon. When BWC finds out that the initial injury wasn’t reported as a claim and the employer chose to pay cash for treatment, that employer now has a non-covered claim. That means the employer will b