News and Updates

Category: Employee Benefits

Benefits Recap: Reminders for 2024 & Changes for 2025

ACA Updates & Reminders It’s almost time for ACA reporting! There aren’t any major changes this year, but here are some items to be aware of for the 2024 tax year. The employee distribution deadline for the 1095-C forms is March 3, 2025. Since the 2023 tax year, the IRS requires all employers with more than ten (10) forms to report electronically. Employers can complete this either directly through the IRS website or through a third-party provider. Corrected forms are also required to be submitted electronically. If you’re submitting 10 or fewer forms, you can still file on paper. The deadline for this is February 28, 2025. The deadline for e-filing 1095-C and 1094-C forms to the IRS is March 31, 2025. Keep in mind that there could be additional ACA state reporting requirements for your organization with differing deadlines. The states to pay special attention to are California, New Jersey, Massachusetts, Rhode Island, and the District of Columbia. Updated penalties and affordability percentages. The ACA penalizes Applicable Large Employers (ALEs) that don’t offer what’s considered affordable coverage to full-time employees (FTEs). The affordability percentage is the maximum amount of an employee’s pay that “Employee Only” coverage can cost the employee in order to be considered affordable by ACA. For 2024, that percentage is 8.39%. The affordability percentage will jump to 9.02% for 2025, and the associated fines will

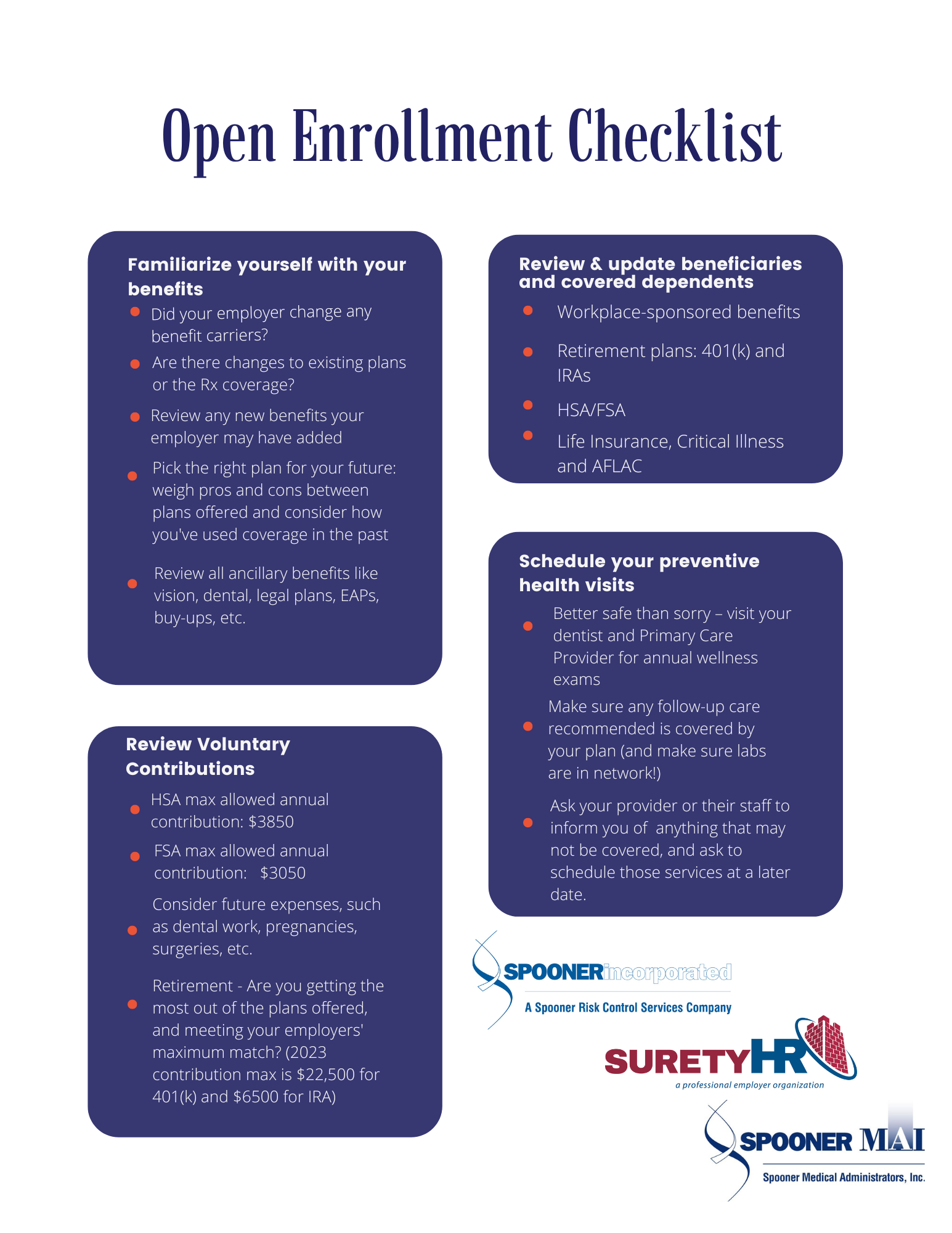

Open Enrollment Checklist for Employees

There's no shortage of checklists for HR managers and benefits administrators reminding them of what boxes to check during open enrollment. Those are great tools for management, but what about the group that tends to need the most guidance with benefits - employees? We put something together that you're free to download (just right click and save image), or you can request a high resolution printable by emailing

If Your Company Isn't Offering a Retirement Plan - Why Not?

The pandemic has taught businesses a lot – patience, flexibility, ingenuity, and most importantly – the value of your employees. Now more than ever, workers (and candidates) have become very selective about who they work for, and what they expect from their employers. That could mean pay scale, paid time off, flexible schedules, health insurance, retirement plans and other benefit offerings. Some of these things are fairly easy to offer, and others more complicated or costly. One thing is certain – if you’re not competitive with benefit offerings, you stand to lose good employees to a business that is. The assumed cost and administrative work involved with setting up and maintaining a retirement plan is the reason many employers give for not offering one, or not making a move to a better plan. Spooner’s 401(k) MEP (multi-employer plan) gives businesses the ability to provide this valuable benefit with minimal effort and start-up costs. A multi-employer plan doesn’t mean it’s a one-size-fits-all plan design. Those details will still be determined by the employer with the guidance of our partner, Vantage Financial. Vantage acts as the co-fiduciary on the plan, and will provide you and your employees with the same helpful advice as they have with our own staff. From gauging what type of investor they want to be, to projections that can help them meet their goals - our teams will work together to help your workforce plan for the