News and Updates

Category: Group Retro

Find the Right Workers' Comp Partner for Your Business

Even though the 2025 BWC policy year is just about to kick off, we’re already preparing to quote 2026-27 policy year Group Rating and Group Retro programs. It can be hard to feel like a savvy buyer when it comes to workers’ comp in Ohio, but Spooner would like to share some pointers for how to understand the timeline and choose the best partner. If you’re thinking of changing your partner for Group Rating or Group Retro, DO NOT complete the renewal that your current TPA sends this summer. Employers often don't realize that cutting a check for a renewal in summer of 2025 obligates them to their current TPA through June of 2027. Make sure your accounting team is aware of this, too. We’ve seen too many unhappy customers of other TPAs get trapped this way. "Since our business is a member of XYZ Chamber of Commerce or trade association, we have to utilize their partner for workers’ comp programs." Not the case! The sponsoring organization frames it that way because there’s money on the table. For example, if your business belongs to XYZ Chamber (who happens to be partnered with a specific TPA) and you want to leave that TPA, the Chamber makes less money. Naturally, they want you to stay with their partner, and may even suggest that such a discount isn’t available outside of that partnership. This is patently false. Most TPAs have access to all of the same Group R

We Won Again: An Update on Withheld Group Retro Refunds

The team at Spooner Risk Control Services, Kent Elastomer Products, Inc. and Roetzel & Andress have scored another win in the fight to get businesses the Group Retro refunds they’ve earned. Background: At the end of 2020, we shared Ohio BWC’s decision to withhold Group Retro refunds owed to participating employers for the 2018 and 2019 policy years. This was based on the concept that employers were already returned 100% of premiums for those years via dividends released to Ohio employers in April and October of 2020. However, dividend distribution and Group Retro refunds are governed by different rules, and different portions of the Ohio Revised Code. We appealed this decision in August 2020, kicking off a legal battle with Ohio BWC that will continue into 2025. After the victory for Group Retro participants in February 2023, BWC appealed the magistrate’s ruling, stating five objections. A hearing was held on November 19, 2024 by the 10th District Court of Appeals, and four of the five objections were overruled. For the reasons detailed here, the court again ruled in favor of Ohio businesses granted a limited writ of mandamus (meaning BWC is obligated to pay out Group Retro refunds). Hellbent on not paying these earned program refunds to employers, BWC chose to file yet another appeal on December 30, 2024 arguing their reasoning for withholding the refunds. From here, the matter will be referred to the Supreme Court of

Group Rating Enrollment Ends November 15

The clock is ticking on Group Rating enrollment for the 2025 Ohio BWC policy year! The deadline for Group Rating paperwork is November 15, 2024. The Group Rating program provides upfront premium savings for qualified Ohio employers. If you are a Spooner client and are eligible for Group Rating, you should have already received your program renewal from us. If you haven’t, please reach out to your client services manager. If you’d like to receive a quote for Group Rating from Spooner Inc., we can accept requests through Wednesday, November 6. You can complete an authorization online by visiting this page. Keep in mind that waiting this long for a quote means you’d have a maximum of one week to make your decision once you receive it. No one likes feeling rushed, so we’d suggest getting your request in as soon as possible! Not all Ohio employers are eligible for Group Rating, and may want to consider the Group Retrospective program enrolls through January 27th. Usually referred to as Group Retro, employers enrolled in this program will see savings down the road once actual vs. expected losses are measured. For businesses that aren’t eligible for Group Rating, and don’t have the flexibility of waiting to see savings, we’d also encourage you to explore SuretyHR, our self-insured PEO (professional employer organization). SuretyHR is an alternative to being insured by Ohio BWC for workers’ compensation. By creating a

Choosing the Best Workers' Comp Partner for '24-25

Even though the 2024 BWC policy year is just about to kick off, we’re already looking ahead to 2025 Group Rating and Group Retro programs. It can be hard to feel like a savvy buyer when it comes to workers’ comp in Ohio, but Spooner would like to share some pointers for how to understand the timeline and choose the best partner. If you’re thinking of changing your partner for Group Rating or Group Retro, be sure not to complete the renewal that your current TPA sends this summer. Most employers don’t realize that cutting a check for a renewal in summer of 2024 will obligate them to their current TPA through June of 2026. Make sure your accounting team is aware of this, too. We’ve seen too many unhappy customers of other TPAs get trapped this way. Are you under the impression that because you’re a member of XYZ Chamber of Commerce, you have to utilize their partner for workers’ comp programs? Not the case. The sponsoring organization frames it that way because there’s money on the table. For example, if you are an XYZ Chamber member (who happens to be partnered with a specific TPA) and you want to leave that TPA, XYZ Chamber makes less money. Naturally, they want you to stay with Sedgwick and may even advise you can’t get that discount outside of their partnership. This is patently false. Most TPAs have access to all of the same Group Rating and Group Retro programs for all industries, and the sponsoring org

2 Hour Safety Training Due June 30

If your company participated in Group Rating or Group Retro during the 2023 policy year (July 1, 2023-June 30, 2024) and had a claim during the green year(s), you’re required to complete two hours of safety training by June 30, 2024. Please be sure to complete submit the training certificates to your team at Spooner (or your TPA, if you’re not a Spooner client). If you’re unsure if you need to complete this training, reach out to your client services manager. The training doesn’t have to be completed in person – so there’s still time to meet the requirement by participating in one of BWC’s online courses. Here are some details on fulfilling the two-hour training requirement, per the Ohio BWC website. Two-hour Training Options A variety of training sources are available for you to fulfill this requirement. They include the following offered through BWC’s Division of Safety & Hygiene: • Education and Training Services Center courses • Ohio Safety Congress & Exposition (OSC) safety education sessions • Safety council seminars, workshops, or conferences featuring a safety topic that are at least two hours long (Safety council monthly meetings do not qualify.) Guidelines for courses offered through non-BWC training forums • The group sponsor, third-party administrator, or an independent sourc

Ohio BWC Update to Wrap Up 2023

Ohio Bureau of Workers’ Compensation will be rolling out several changes that will impact Ohio employers in 2024. We mentioned back in August that the way base rates are structured may be changing, which BWC has confirmed. It’s uncertain how this will impact the end premiums, but no big swings are anticipated. We’ll be keeping our clients informed about any major changes. The following rating elements will also be changing, with the potential to impact future premiums: • Deductible Factors • Individual Retro – minimum premium factors • Group Retro - loss development factors • Premium Size Credit – ranges and factors This is also a “wait and see” situation, as we don’t yet know exactly what changes BWC plans on making to these elements. Certificates of coverage will look different next year as well. They’ll now also list the employer’s MCO, any additional insureds, officers, who is eligible for elective coverage (such as owners), and NCCI codes and descriptions, in addition to the company’s address. As of now, if employers need to make a minor change or correct an error in a company’s policy name, they had to complete a specific form and fax or mail that form back to BWC. The only way this process could be made slower would be by carrier pigeon. Luckily, they’ve stepped int

Choosing the Best Workers' Comp Partner for Your Business

Even though the 2023 BWC policy year just started, we’re already looking ahead to 2024 Group Rating and Group Retro programs. It can be hard to feel like a savvy buyer when it comes to workers’ comp in Ohio, but Spooner would like to share some pointers for how to understand the timeline and choose the best partner. If you’re thinking of changing your partner for Group Rating or Group Retro, be sure not to complete the renewal that your current TPA sends this summer. Most employers don’t realize that cutting a check for a renewal in summer of 2023 will obligate them to their current TPA through June of 2025. Make sure your accounting team is aware of this, too. We’ve seen too many unhappy customers of other TPAs get trapped this way. Are you under the impression that because you’re a member of XYZ Chamber of Commerce, you have to utilize their partner for workers’ comp programs? Not the case. The sponsoring organization frames it that way because there’s money on the table. For example, if you are an XYZ Chamber member (who happens to be partnered with a specific TPA) and you want to leave that TPA, XYZ Chamber makes less money. Naturally, they want you to stay with their TPA and may even advise you can’t get that discount outside of their partnership. This is patently false. Most TPAs have access to all of the same Group Rating and Group Retro programs for all industries, and the sponsoring orga

2018 & 2019 Group Retro Update

Many of you may be wondering what the status is of the Group Retro lawsuit that we talked so much about in February. Just over two months have passed – but when it comes to legal matters, it’s not much time at all. To catch you up to speed, a magistrate determined in February that BWC abused their discretion by withholding Retro refunds. BWC had a two-week window following that 2/6/23 decision to file any objections to the decision – which of course, they did. They chose to reiterate several points from their original arguments, and indicated that they did possess the authority to change a portion of the Revised Code without going through the typical rulemaking process. Our lead plaintiff, Kent Elastomer, and their counsel at Roetzel & Andress have already filed a response to those objections. We’re waiting to see if the full court of appeals wishes to hear oral arguments or proceed with the record that has already been established. Unfortunately, there is no timetable on these next steps, but we will keep you updated here on our blog, on our LinkedIn page, and through our client services managers (if you’re a current Spooner client). If you participated in Group Retro during the 2018 or 2019 policy years and would like to be on our roster so we can fight for your refunds when the tie comes, complete this form and one of our team members will be in touch with

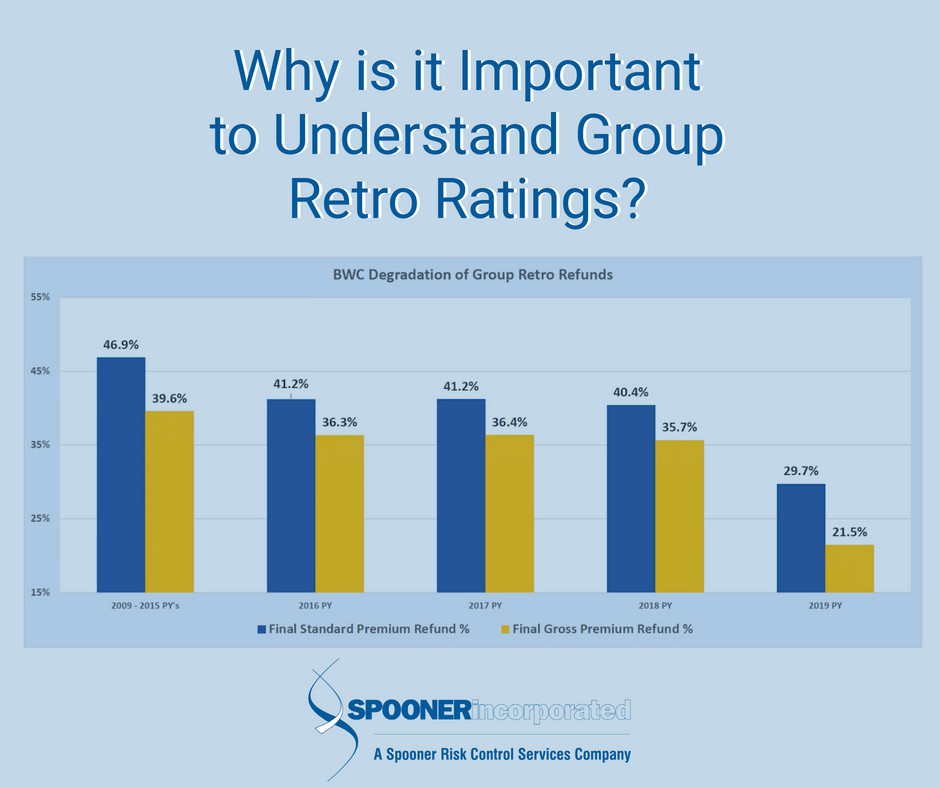

Disappointed with Your 2020 Group Retro Refund?

You’re not alone. Now that BWC is releasing the first Group Retro checks (and a few assessments) for the 2020 policy year, many Ohio employers are underwhelmed by the results. In the earlier days of Group Retro, it wasn’t unheard of to see refunds over 50%. Spooner certainly had its heyday in the program, with some of our industry groups reaching close to the maximum return of 63%. In the last ten years, we’ve seen several factors begin to chip away at these big returns: increased loss development factors, fewer premium dollars in pools due to Premium Size Factor Reductions, and more recently – the move to a new reserve calculating system called ACES. The first two changes caused average returns to dip into the 40% ranges, but huge reserves from ACES delivered a sucker punch that left only five of the best performing groups with returns over 40%. Five of the hardest-hit pools will receive an assessment, which means paying back anywhere between 15-25% of their 2020 premiums to BWC. All other groups in the middle of the best and worst averaged returns of less than 24%. For some, that’s less than half of their historical performance average. We’ve been tracking the impact of ACES on Group Retro for a while now, and several TPAs (including Spooner) have voiced their concerns to BWC regarding the dwindling returns. While the complaints were taken under advisement, BWC chose to make such minor changes to the reserve calculations t

The Good, the Bad & the Ugly: 2020 Group Retro Performance

Since the 2020 policy year wrapped, we’ve mentioned the lackluster performance of several Group Retro pools. These poor returns, as well as a few assessments, are occurring largely in part to BWC’s move to the ACES reserves system, and aren’t necessarily tied to the performance of any one TPA. Luckily, Spooner’s pools remain steady (this is the good), but they may not be the returns we’ve seen in years past. On July 28, we received what will be the final numbers used to calculate the first round of Group Retro returns for those enrolled during the2020-2021 policy year. Out of 53 groups across all industries, only five performed above the 40% mark. This is increasingly important to remember as you shop 2023-24 programs this summer, and you’re seeing 50-60% returns being promised. The remainder lingered between 10-38% (the bad), with a few more in the red – meaning employers in those pools will be assessed, i.e. billed for their share of the difference (the ugly). Many decision makers don’t make note of the “maximum assessment” when they complete their Group Retro paperwork. This is a percentage disclosed that equates to how much of that year’s premium you’ll be responsible to pay back to Ohio BWC if the performance of your Group Retro pool is worse than expected. Here’s a real-life example of one of the groups being assessed. This particular pool was assigned a 20% maximum assessment,