News and Updates

Month: August 2021

A Closer Look Inside Spooner's 401(k) MEP

We've shared a few details about our multi-employer retirement program in the past, but now we're taking a deeper dive into the details of Spooner's 401(k) offering that can be tailored to suit any size business, in virtually any industry. We'll outline details on both the employer and partcipant experience, as well as a true look at the fee structures involved. Some businesses have entered our MEP as a first-time offering to employees, and some have transfered assets from an existing plan into ours, saving them thousands on fees. Take a closer look by clicking here, and reach out to our team with any

2020 Policy Year True Up Reminder!

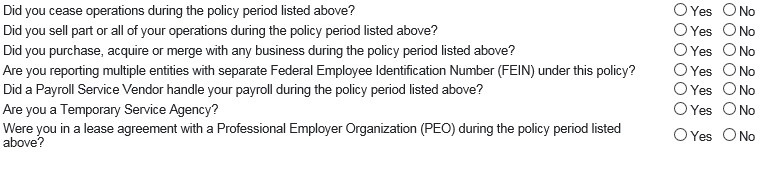

It’s a wrap on the 2020 policy year, which means you should be submitting your company’s annual payroll True Up to BWC. True Up is a process required by Ohio BWC at the end of each policy year, where your premiums based on projected payroll are balanced with premiums based on your actual payroll for the past year. Compliance with both the reporting and payment of any balances affects your company’s eligibility for most savings programs. The “deadline” to submit your payroll true-up reports on the Ohio BWC website is August 15th – but there are some finer details to consider. August 15 falls on a Sunday, which makes the deadline Friday August 13, realistically speaking. We’ve also learned that historically, you should allow 24 hours for posting – which makes the real deadline Thursday August 12. You will also need to pay any applicable balances if your payroll was higher than what the Ohio BWC estimated for the period of July 1, 2020 to June 30, 2021. Balances are expected to be paid during the designated reporting period, but there is a small grace period on both reporting and payments. If you are unable to pay the entire balance at the end of the reporting process, please note that any future payments will first be applied to your delinquent True Up Balance before being applied to your premium installments. Payment plans for True Up balances are only available through the Ohio Attorney

BWC Excludes COVID-19 Claims from Experience

Ohio BWC recently amended a portion of the Ohio Revised Code (ORC) as it applies to employers’ experience periods. A subsection was added to 1423-17-03 (subsection 4 of Section G) with the following language: “Actual losses where COVID-19 was contracted by an employee arising during the period between the emergency declared by Executive Order 2020-01D, issued March 9, 2020 and July 2, 2021 which is fourteen days after the executive order was repealed, shall be excluded from employer's experience for the purpose of experience rating calculations.” BWC’s Board of Directors noted in its Executive Summary on the proposal that pandemics are typically considered catastrophes due to scope and severity, and are typically excluded from the experience rating process. This comes as a huge relief to thousands of Ohio employers who had workers’ compensation claims filed to their policy as a result of employees presumably contracting COVID-19 while on the job. Even with contact tracing, it is difficult to determine where an employee may have contracted the virus – therefore difficult to determine the employer’s level of liability. Experience Rating refers to the calculation of an employer’s payroll and loss history within a certain period of time, and is used to determine future rates (insurance premiums) as well as EMR (experience modifier rate). You can view the entirety of the ORC entry

OSHA Region 5 Hearing Conservation Focus

OSHA’s Region 5, which includes Ohio, Michigan, and Indiana, issued a press release announcing a Regional Emphasis Program (REP) for Exposure to Noise Hazards in the Workplace. The goal of the REP is to encourage employers to take steps to identify, reduce, and eliminate hazards associated with exposure to high levels of noise. Prior to the initiation of enforcement, a three-month period of education and compliance assistance to the public will be conducted to support the efforts of the Agency in meeting the goals of the REP. Enforcement related to this REP will begin on September 01, 2021. By law, OSHA requires employers to implement a hearing conservation program when the average noise exposure over eight working hours reaches or exceeds 85 decibels, which the Centers for Disease Control compares to the sound of city traffic (from inside the vehicle) or a gas-powered leaf blower. Nearly one in 10 people endures noise levels at work loud enough to cause hearing loss while seven in 10 experience moderately loud noise levels. A Bureau of Labor Statistics Survey published in 2019 found that more than half of the nation’s manufacturing workers reported not using personal protective equipment (PPE) to protect their hearing. If you have concerns regarding noise levels in your facilities, reach out to Spooner’s Safety team at

Group Retro Updates: 2018, 2019 & 2020

We promised to keep you informed on the status of 2018 and 2019 policy year refunds from BWC’s Group Retro program. As it stands, no employers enrolled during those years will be receiving any refunds. Typically, in the fall of 2021 Group Retro participants should be receiving your first refund from the 2019 policy year and your second refund from the 2018 year. It’s important to understand that if these refunds are normally included in your budgeting process for the coming year, you should not factor that in. For more info on why BWC chose not to release these funds, and what Spooner is doing to help Ohio employers, check out our June blog entry on these missing Group Retro Refunds. If your company was enrolled in Group Retro for the 2020 year, your first refund will be paid out in the fall of 2022. Since the 2020 policy year recently ended, we also have an updated outlook on those returns. Out of the 45 total Private Employer Group Retro pools in Ohio, data from BWC shows that 31 of them will have an assessment for their first year (due in fall 2022). This means that companies in that pool will be billed by BWC for a portion of 2020 premiums instead of receiving a refund. This is largely due to BWC moving to a system called ACES to determine reserves on claims as of July 1, 2020. We believe BWC is open to discussing changes to some of the variables used to calculate refunds in response to the impact ACES is having on 2020 Group Retro