News and Updates

Category: workers compensation

MCO Open Enrollment is Here!

Many of you know that every two years in May, MCO Open Enrollment occurs. This is the time that Ohio employers can choose the Managed Care Organization (MCO) they’ll work with for the next two years, and beyond. If you’re reading this and Spooner Medical Administrators, Inc. (SMAI) isn’t your MCO, now’s the time to move on possibly the best business decision you’ll make this year. Especially if you work with Spooner Inc. as your TPA, having SMAI as your MCO really opens the lines of communication between both parties. SMAI's team is ready to schedule a call, Zoom, or in-person meeting with you anytime through May 26. Click here to send them a message, or give them a call. Remember, MCO Open Enrollment only comes around every two years and only lasts four weeks. If you’re on the fence, it may be time to take a chance. Switching MCOs costs nothing, but when claims are managed poorly from a medical perspective - you’ll feel the sting down the road in your BWC premiums. Additionally, bi-weekly management calls and customizable reports can help you feel like you’re never out of the loop with what’s happening in your claims. Speaking of staying informed - SMAI's proprietary web-based software allows you create and run customized reports 24/7, report a claim at any hour, search in-network providers, and even create multiple company logins with different restrictions and a

BWC to Host Open Forum on ACES

On October 14, BWC will host an open forum with TPAs to discuss the impact of their new reserve system called ACES. Spooner’s goal is to convince BWC that this system is overestimating reserves for lost time claims (as well as some medical only claims) that will have a dramatic effect on Group Retro refunds for the 2020 policy year and future years. This could also have a negative impact on employers’ EMRs for the 2023 policy year. BWC implemented this new system of calculating reserves in January 2021. As early as June, we began noticing reserves jumping to nearly 4-5 times what they would have been under the previous system and industry standard, MIRA II. We shared another update in August, after reviewing the first round of results for 2020 Group Retro and finding that 68% of pools could face a first year assessment, as opposed to getting a refund from the program. These open forums held by BWC are a platform for TPAs to voice concerns over certain policy and procedure changes that may negatively impact Ohio businesses. Spooner is an Ohio business, and our family of companies make it a priority to fight for policy changes that will have a positive impact on the business community that we’re so proud to be a part

Ohio BWC Expands Dividend To Employers with Late 2019 True-Ups

Some previously ineligible Ohio employers will soon be receiving dividends from Ohio BWC totaling 372.46% of their 2019 policy year premiums. Gov. Mike DeWine made a request to BWC’s board of directors to distribute dividends to roughly 3,000 policyholders who had not initially met the eligibility requirement of completing their True Up in a timely fashion. BWC announced on September 24 that their board had moved to approve this measure, releasing another $30 million in funds to be divided amongst these remaining employers. Historically, when BWC has announced a dividend – a policy must be current and in good standing to receive their portion, which includes having completed their “True Up” process prior to the August 15 deadline each year. Businesses that fall under this eligibility expansion will be contacted directly by BWC regarding the dividend. Remember that any current premium balance due will be deducted from the dividend amount before the check is issued. BWC has issued over $9 billion in dividends to Ohio employers since

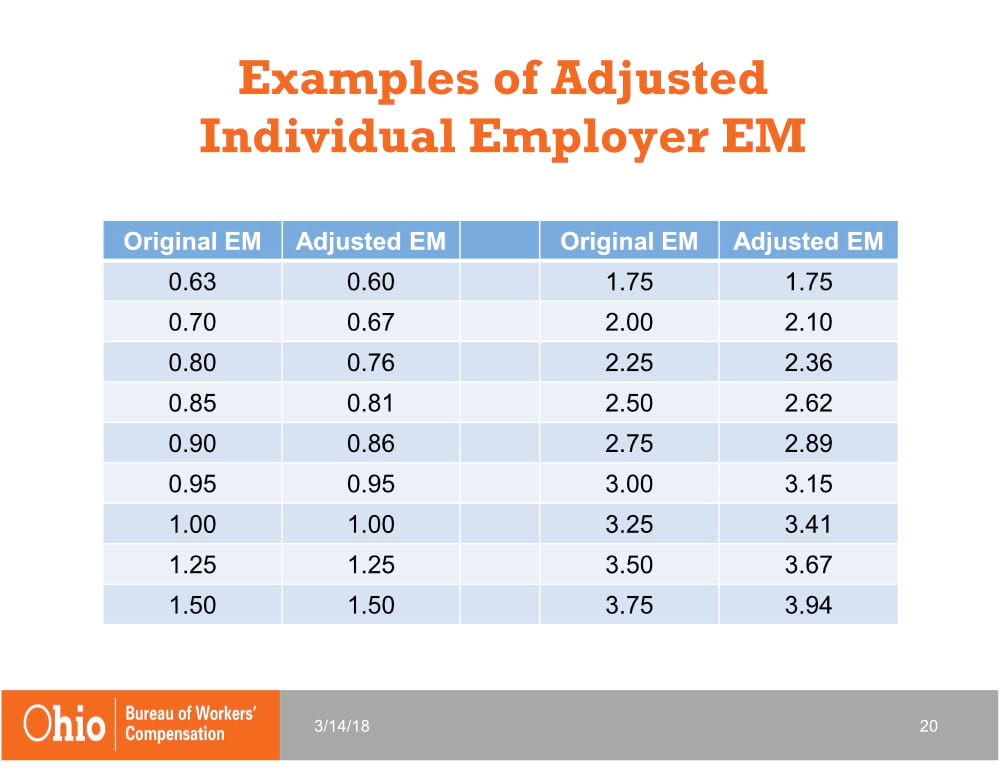

BWC Excludes COVID-19 Claims from Experience

Ohio BWC recently amended a portion of the Ohio Revised Code (ORC) as it applies to employers’ experience periods. A subsection was added to 1423-17-03 (subsection 4 of Section G) with the following language: “Actual losses where COVID-19 was contracted by an employee arising during the period between the emergency declared by Executive Order 2020-01D, issued March 9, 2020 and July 2, 2021 which is fourteen days after the executive order was repealed, shall be excluded from employer's experience for the purpose of experience rating calculations.” BWC’s Board of Directors noted in its Executive Summary on the proposal that pandemics are typically considered catastrophes due to scope and severity, and are typically excluded from the experience rating process. This comes as a huge relief to thousands of Ohio employers who had workers’ compensation claims filed to their policy as a result of employees presumably contracting COVID-19 while on the job. Even with contact tracing, it is difficult to determine where an employee may have contracted the virus – therefore difficult to determine the employer’s level of liability. Experience Rating refers to the calculation of an employer’s payroll and loss history within a certain period of time, and is used to determine future rates (insurance premiums) as well as EMR (experience modifier rate). You can view the entirety of the ORC entry

Surety HR: Not Your Average PEO

When we talk to prospects about Surety HR, our self-insured PEO (professional employer organization), we get a lot of very different reactions - confusion, curiosity, blank stares and occasionally – a crossed-arm refusal to hear anything else about it. We knew when we began building our PEO that several employers have a bad taste in their mouth about PEOs, usually after having (or hearing about) a bad experience. That’s one of the many reasons we sought out these opinions to help build our framework based on what employers feel does or does not work. The biggest thing we want to make clear is that we are not our competition. We don’t charge based on a percentage of payroll, baking everything together so that you’ll never really know how much you’re paying for any of our services. When employers are looking for some of the solutions a PEO can provide, they are not always looking to move all their employment-related needs under one umbrella. This is why larger, mature, and sophisticated companies have avoided entering into a PEO relationship. Surety HR is a sister company of Spooner Incorporated – an unrivaled TPA and consulting firm with less than 2% client turnover. Because of this foundation, our focus is more on lowering workers’ comp premiums instead of bundling services that you may not need or want. It also means if and when you decide it’s time to exit the PEO, the process will b

Another Successful Open Enrollment for Spooner Medical Administrators

Our MCO, Spooner Medical Administrators, had another successful open enrollment this past May! We realize that marketing can be very cut-throat (and not always transparent) during the short biennial enrollment period, and other MCOs may have offered you the moon to stray from SMAI. Despite what other MCOs and the BWC’s report card might say about SMAI - we continue to have controlled, steady growth and incredible retention. The Spooner family of companies would like to thank the thousands of businesses that chose to retain SMAI as their MCO, and the hundreds of new companies that chose SMAI as their new partner. We look forward to continuing to build our relationships with you and are thankful for our 12th consecutive successful

Spooner Medical Administrators, Inc. URAC Accredited

URAC's case management accreditation standards require companies to establish the policies, procedures, and structure needed for optimal case management

Spooner Medical Administrators, Inc. Pharmacy Reports

Our best practice of providing access to “pharmacy reports” helps lower workers’ compensation costs by ensuring prescription requests are medicinally appropriate for each

Spooner Medical Administrators, Inc. Web Access

Spooner MAI's best practice of "web access" helps to lower the costs of workers' compensation by ensuring that employers have access to all of the information that they need in a timely manner. All of our best practices help to ensure that every treatment and payment is medically appropriate for each claim.

Spooner Medical Administrators, Inc. Customized Claim Reports

Spooner MAI’s best practice of “customized claim reports” helps lower workers’ compensation costs by ensuring that every treatment and payment is medically appropriate for each