News and Updates

Month: August 2022

2021 BWC True Up

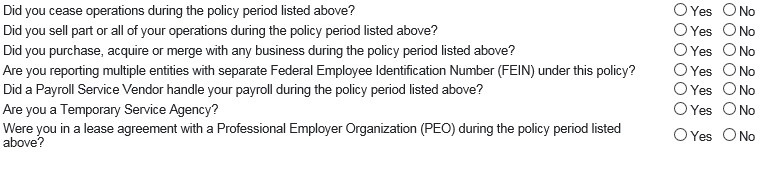

It’s that time of year again – Ohio BWC True Up! Employers can be intimidated by this process, but it should be relatively easy. Since state fund employers pay Ohio BWC premiums based on projected payrolls, everyone has to settle up at the end of the year. BWC policy years begin on July 1, and you have 7/1 through 8/15 to not only complete the reporting process, but also to pay any resulting balances. If you are unable to pay the entire balance at the end of the reporting process, any future premium payments will first be applied to your delinquent True Up Balance before being applied to any premium installments. Payment plans for True Up balances are only available through the Ohio Attorney General’s office following an application process (and having a balance with the AG could prevent you from getting into a savings program). Employers should also be prepared to answer the following questions as part of the True Up reporting process: This is a requirement for any Ohio employer with an open state fund policy, even if no payroll is allocated to the policy. Most self-insured PEOs ask that Ohio employers keep a state fund policy open and pay the annual minimum premium, but report no payroll to it. Even those employers are required to complete the report – essentially verifying that the estimate of $0 in payroll is still accurate. Your PEO might take care of this for you (SuretyHR does), or your payroll provider might assist you with the repor

Should We Cover Independent Contractors for Workers' Comp?

Don’t let the 1099 fool you. Just because your company doesn’t send these workers a W-2 doesn’t mean you shouldn’t cover them for workers’ compensation in Ohio. You may be thinking, “We’re not concerned – all of our 1099ers have a certificate of coverage from BWC.” Ok, so they knew that they had to manually elect coverage for themselves if they’re an LLC filing as a sole corp right? It can be more complicated than it appears on the surface, but we’re here to help you get a handle on it. Keep in mind this is not legal advice. If you have specific situations about classifying workers, you can always reach out to us, but sometimes it’s best to follow up with an employment attorney. Navigating the world of gig workers can be tricky, but just ask Ugicom – it’s best to classify workers correctly from the beginning. A lot of employers will casually mention that they don’t have to cover certain workers as employees for workers’ comp, because these people are independent contractors. Unless they come and go as they please with no schedule parameters, don’t utilize company vehicles or other property, and you have no say in the work they perform - they may in fact be independent contractors. If you can’t confidently tick all of those boxes, it may be time to reevaluate. When Ohio BWC performs a payroll audit, the

Group Rating Renewal is Now Even Easier for Spooner Clients!

We understand that the businesses we serve are dealing with a lot right now - recruiting, attrition, staffing shortages, shipping delays and increasing costs on everything from benefits to raw materials. We can’t fix all of those problem for you, but we can make the process of saving money on BWC premiums a lot easier than it’s been in the past. Instead of completing hardcopies and mailing or emailing them to us, Spooner clients that completed Group Rating forms with us last year (and would like to remain in that program) can now complete their Group Rating renewal on our website. If we have any questions or concerns about your answers, we’ll reach out to the person that completed

The Good, the Bad & the Ugly: 2020 Group Retro Performance

Since the 2020 policy year wrapped, we’ve mentioned the lackluster performance of several Group Retro pools. These poor returns, as well as a few assessments, are occurring largely in part to BWC’s move to the ACES reserves system, and aren’t necessarily tied to the performance of any one TPA. Luckily, Spooner’s pools remain steady (this is the good), but they may not be the returns we’ve seen in years past. On July 28, we received what will be the final numbers used to calculate the first round of Group Retro returns for those enrolled during the2020-2021 policy year. Out of 53 groups across all industries, only five performed above the 40% mark. This is increasingly important to remember as you shop 2023-24 programs this summer, and you’re seeing 50-60% returns being promised. The remainder lingered between 10-38% (the bad), with a few more in the red – meaning employers in those pools will be assessed, i.e. billed for their share of the difference (the ugly). Many decision makers don’t make note of the “maximum assessment” when they complete their Group Retro paperwork. This is a percentage disclosed that equates to how much of that year’s premium you’ll be responsible to pay back to Ohio BWC if the performance of your Group Retro pool is worse than expected. Here’s a real-life example of one of the groups being assessed. This particular pool was assigned a 20% maximum assessment,